Shilo Lewis, a resident of Terrebonne, Oregon, was taken aback by the nearly $100 she spent on a recent haul, which was meant to sustain her and her husband until their next paycheck on October 15.

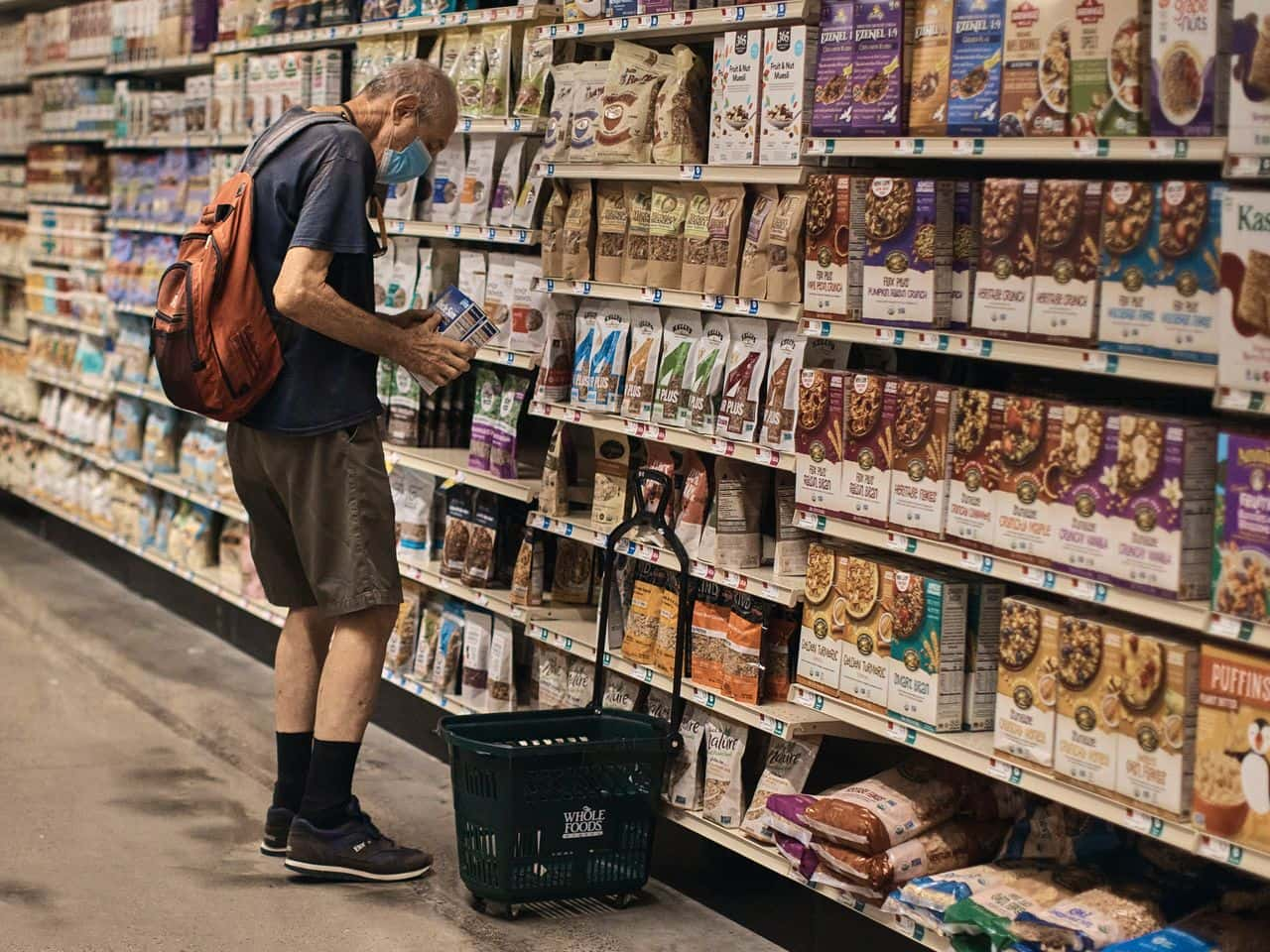

Grocery store prices continue their upward climb, consumers are feeling the strain on their wallets

Over the past two years, grocery store prices have surged by almost 17%, reports the Bureau of Labor Statistics, prompting individuals like Lewis to turn to social media to share their budgetary woes. Across platforms like X and formerly Twitter, users are posting photos of their grocery store purchases, with costs ranging from $200 to over $270. While some critique the inclusion of non-essential items, these posts highlight a widespread awareness of escalating grocery expenses.

A Bankrate study predicts that workers won’t regain their lost purchasing power until late 2024 due to inflation. In this challenging landscape, savvy shoppers are employing money-saving techniques. Aires Withers from Cloverdale, Indiana, demonstrates that strategic couponing and rebates can slash expenses, allowing her to spend just over $53 for more than $100 worth of groceries.

Experts like Barbara O’Neill, a distinguished professor emeritus at Rutgers University, offer practical advice to alleviate the burden of rising grocery store prices

O’Neill suggests leveraging sales, coupons, and store-brand products, and considering wholesale memberships. Additionally, she advises making shopping lists to curb impulse buys and opting for seasonal produce over processed items.

Ultimately, O’Neill emphasizes that these small grocery store prices adjustments can make a significant difference, especially if the savings are channeled into high-yield accounts or investments. As consumers grapple with inflation, proactive measures in spending habits may prove crucial in weathering these economic challenges.

READ ALSO: U.S. Student Loan Balance Trends: $1.765 Trillion As Repayments Resume, Stocks React