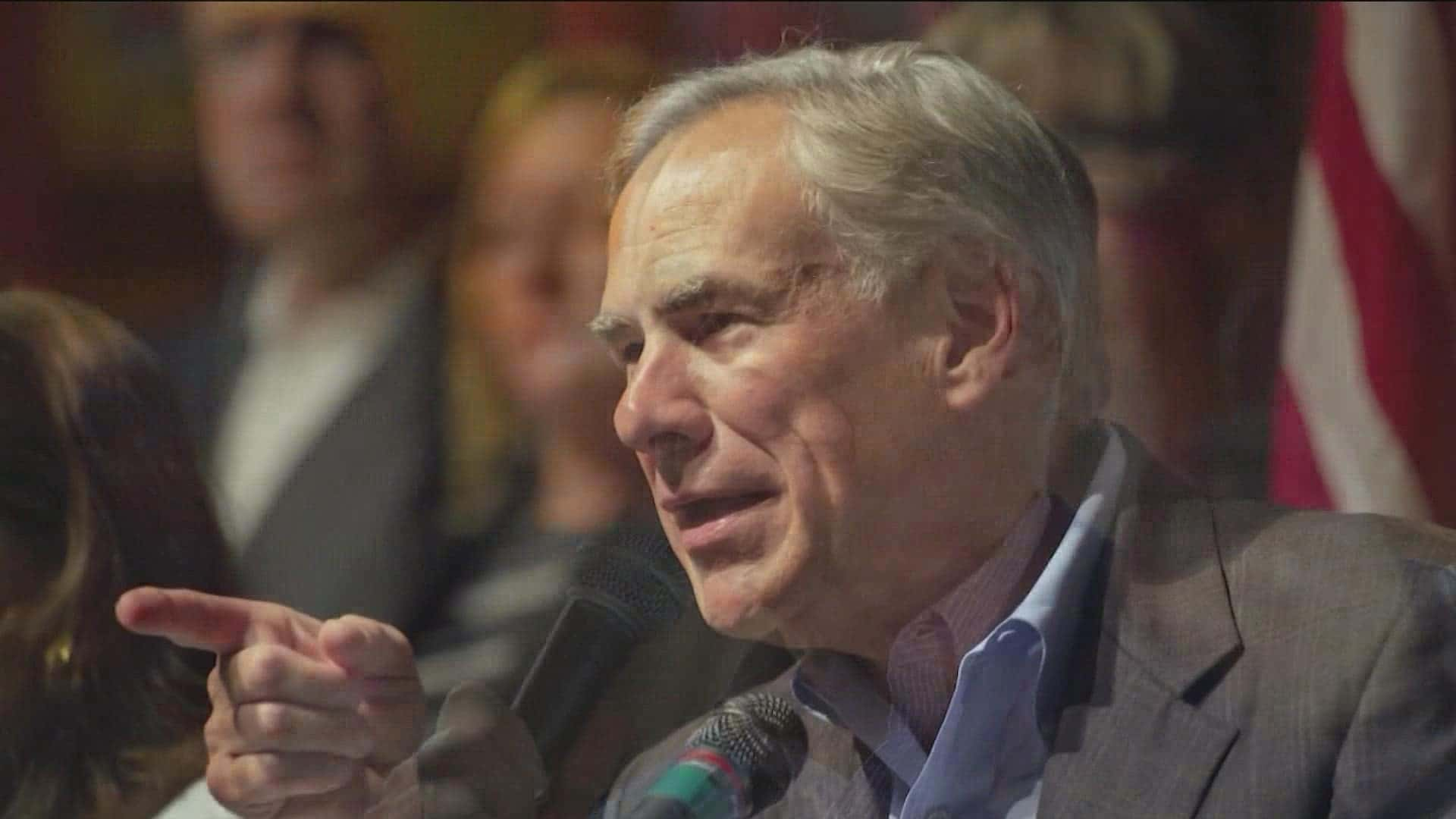

AUSTIN, Texas — As the legislative special session enters its second week, a final agreement on property tax cuts appears no closer to being reached, as Governor Greg Abbott presses down on tax rate compression and issues his harshest condemnation yet of Dan Patrick-backed homestead exemption hikes.

Abbott Has Advocated For The Abolition Of Property Taxes, But It Is Unlikely

“Taxpayers are angry that their property valuations and taxes continue to rise year after year,” Abbott stated in a tweet Monday morning. “Raising homestead exemptions evaporate after a few years of home valuation increases.”

Abbott has long advocated for the abolition of property taxes in Texas, and he implied in his tweet that Patrick’s homestead exemption would not result in such a move. Despite being only a tweet, Abbott’s comments are noteworthy because he had not yet directly challenged Patrick’s homestead exemption idea.

“Given what’s happened so far, it’s highly unlikely that we’ll see a property tax bill come out of this session,” said Joshua Blank, research director at the Texas Politics Project. “However, it’s not impossible that another special session will be called almost immediately to address the same issue.”

READ ALSO: Gov. Gavin Newsom Proposed Multiple 2023-24 Budget Cuts, Causing Concern

Governor Abbott Has Proposed Extending The Homestead Exemption To Increase The Tax-free Portion Of A Home’s Value

Gov. Abbott has stated several times that several special sessions will be held to address topics that were not enacted during the regular session. It’s not out of the question that another session will focus on property taxes.

For the first time since the dramatic House adjournment, the Senate did not refer the House’s compression-based tax cut plan to a committee, thus stalling the legislation. The bill could be debated in the coming days; the Senate is scheduled to reconvene on Tuesday evening.

Lieutenant Governor Dan Patrick, who chairs the Senate, has advocated for extending the homestead exemption, which would increase the tax-free portion of a home’s value from $40,000 to $100,000.

The House supported a plan that centered on tax rate compression by lowering the maximum school district-compressed tax rate by 16 cents.

“To begin with, compression is the larger, more difficult thing to explain,” Tray Bates, director of Governmental Affairs for Texas REALTORS, explained. “The simplest way to put it is that the state is paying a larger share of the total cost of your local public school budget, putting less strain on the local property taxes required to fill the gap.”

READ ALSO: HHSC Receives Federal Approval To Replace Stolen SNAP Benefits