The Supreme Court declared on Thursday that local governments are no more permitted to maintain the revenues if they acquire your land and sold it at auction due to unpaid taxes.

The court agreed with Geraldine Tyler, 94, of Minneapolis in the majority decision after Hennepin County had taken possession of her condo in 2015 due to $2,300 in overdue real estate taxes and $12,700 in fines and interest. The disputed portion of the tax lien foreclosure process was what took place next: the county auctioned her house at bidding for $40,000 and grabbed the difference in cash.

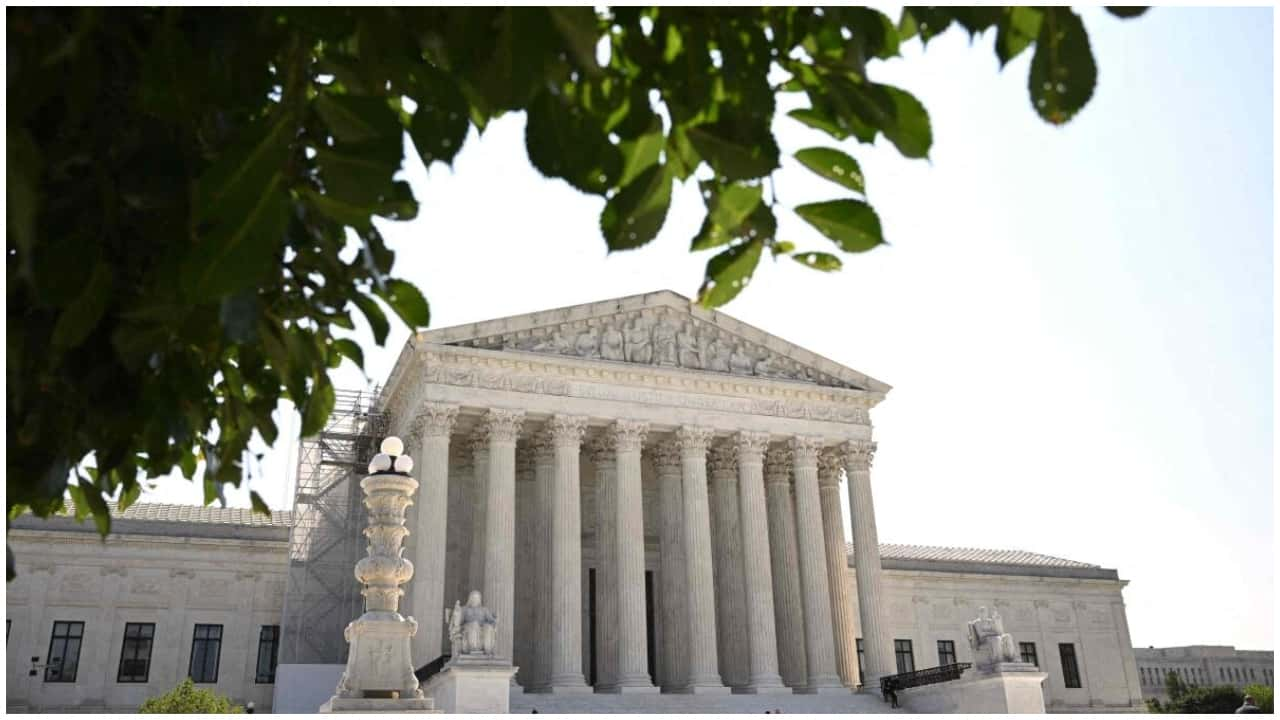

Based on information done by the Pacific Legal Foundation, the nonprofit advocacy organization that is supporting Tyler in the case, such behavior was acceptable before Thursday’s decision in 12 states plus Washington, D.C. According to the court, the practice violated the 5th Amendment’s “takings clause,” which safeguards property rights, and was therefore illegal.