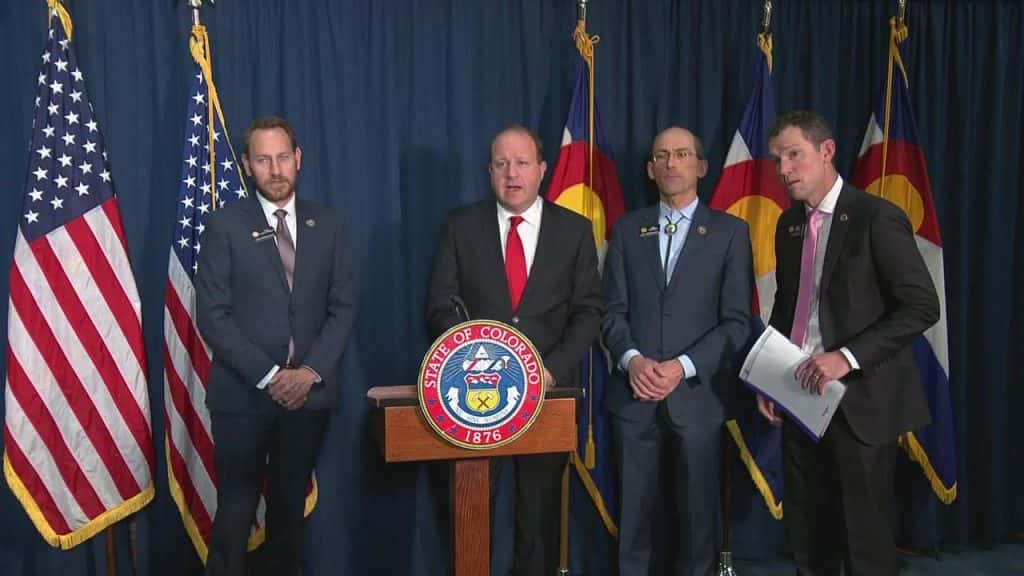

Gov. Polis urged Colorado voters to approve Senate Bill 108.

Gov. Polis Proposes the Senate Bill 108 to Temporary Reduce Property Tax in Colorado

Gov. Jared Polis asked the Colorado voters to approve Senate Bill 108, which will provide temporary property tax reduction to solve the state’s current tax crisis.

According to Gov. Polis, the bill aims to give individuals with properties, including homeowners and business owners, relief by temporarily reducing the residential property tax increases this year by 50%, especially since the state expects a property tax increase for owners this 2023.

Aside from providing property tax relief, Gov. Polis discussed that the bill seeks to solve the issues regarding the 2020 Gallagher Amendment and prevent too much and an unfair increase in property taxes in the state this year and in the upcoming years, reported by Colorado Politics.

READ ALSO: California Bills Proposed To Expand Tax Credits For Low-Income Families Struggling After Pandemic

Gov. Polis Receives Criticism Over Senate Bill 108 Proposal

Following the proposal of Senate Bill 108, Gov. Polis received various criticisms because of the insufficient information about the bill and how it can negatively affect the current property taxes in Colorado.

Several critics claimed that the state doesn’t have enough funding for the proposed property tax relief and accused Gov. Polis of not having Plan B if the voters don’t approve the bill.

READ ALSO: House Bill 1158 Will Provide $515 Million In Tax Relief For North Dakotans