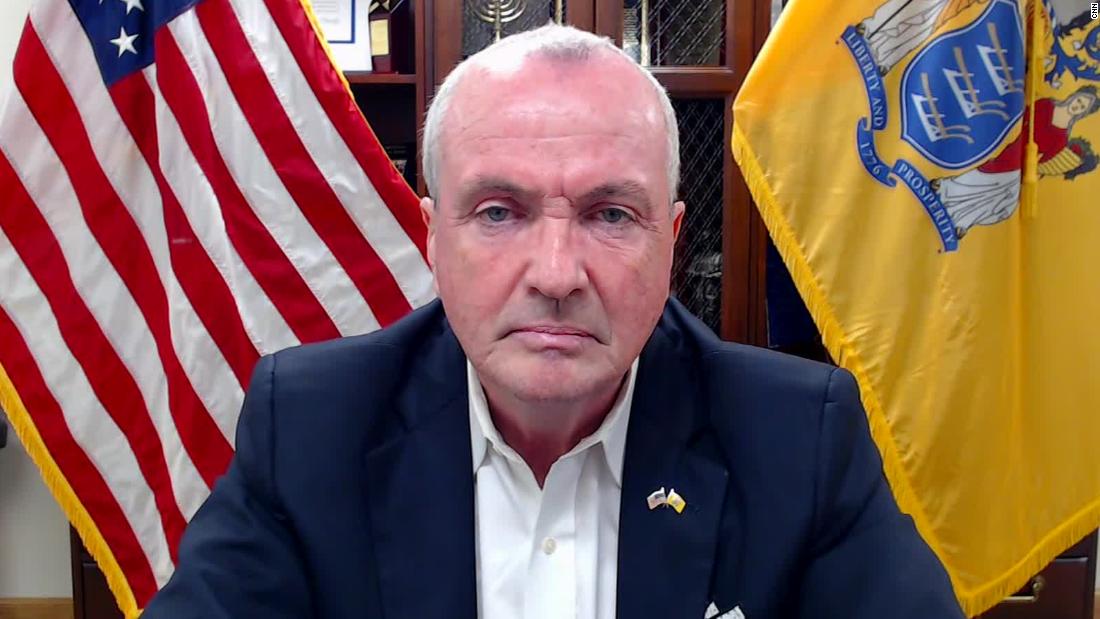

Elevating NJ within his budget statement, Governor Phil Murphy praised his administration’s efforts to “transport out of a crisis.”

Murphy stated, “We had a severe lack of technicians, conductors, and bus operators,” in his budget speech on Tuesday. “Permanent disruptions and last-minute delays were leaving riders and commuters trapped.”

Businesses that earn more over $10 million might be subject to a tax under his new idea, which he named the Corporate Transit Fee. The proceeds would go toward funding NJ Transit’s operations.

Murphy declared, “We will increase this income without placing any additional responsibilities on small and medium-sized businesses.”

Kevin Corbett, the president and CEO of New Jersey Transit, stated in a statement:

“We appreciate that the governor has made it a top priority to establish a steady stream of new, committed financing for NJ TRANSIT. For numerous New Jerseyans who depend on these facilities to get to their jobs, school, or visits for medical care and other needs, transit is a lifeline. The region’s economy depends on maintaining these essential services, especially while we and other transit agencies across the nation continue to recover from the pandemic.

With the support of the governor, our transportation system will remain vibrant, and we will further our efforts to increase safety and dependability, accessibility, and community development throughout the state. We appreciate the governor’s vision and leadership in making this important investment a top priority.”

Strong resistance is being expressed to the planned Corporate Transit Fee from both within and outside the State House.

Assemblyman Christopher DePhillips, a Republican, said that he and a few other Republicans would prefer that the State use the $6 billion surplus in the budget. “We refer to it as a rainy-day support,” DePhillips explained. “For New Jersey Transit, today is not just a wet day—it’s a stormy day.”

Declan O’Scanlon, the Republican Senate Budget Officer, believes that the budget may be changed to eliminate the need for taxes on businesses. According to O’Scanlon, “it’s inappropriate from a policy point of view as well as a messaging perspective.”