The move has attracted attention due to Governor Ron DeSantis‘ efforts to raise his national profile ahead of a possible presidential run.

The Florida State Board of Administration is facing criticism for its decision to move state pension money into riskier investments, potentially affecting retirees collecting pensions

The investigative journalism site The Lever revealed that the DeSantis administration’s pension board, the SBA, transferred state pension funds into higher-risk investments. These pensions are intended for employees like firefighters and teachers. The Lever’s Matthew Cunningham-Cook noted that these investments come with high fees and limited transparency, and some of the private equity and hedge fund managers involved have supported the Republican Governors Association, which donated more than $21 million to the political committee associated with Governor DeSantis, Friends of Ron DeSantis.

According to Cunningham-Cook, this move has resulted in “significant losses” for the pension fund, amounting to $10 billion compared to a traditional index fund of stocks and bonds. The “plain vanilla” investment strategy, endorsed by investors like Warren Buffett, aims to minimize risks.

Governor DeSantis denied the allegations and stated that he hasn’t personally engaged in such actions as part of the SBA

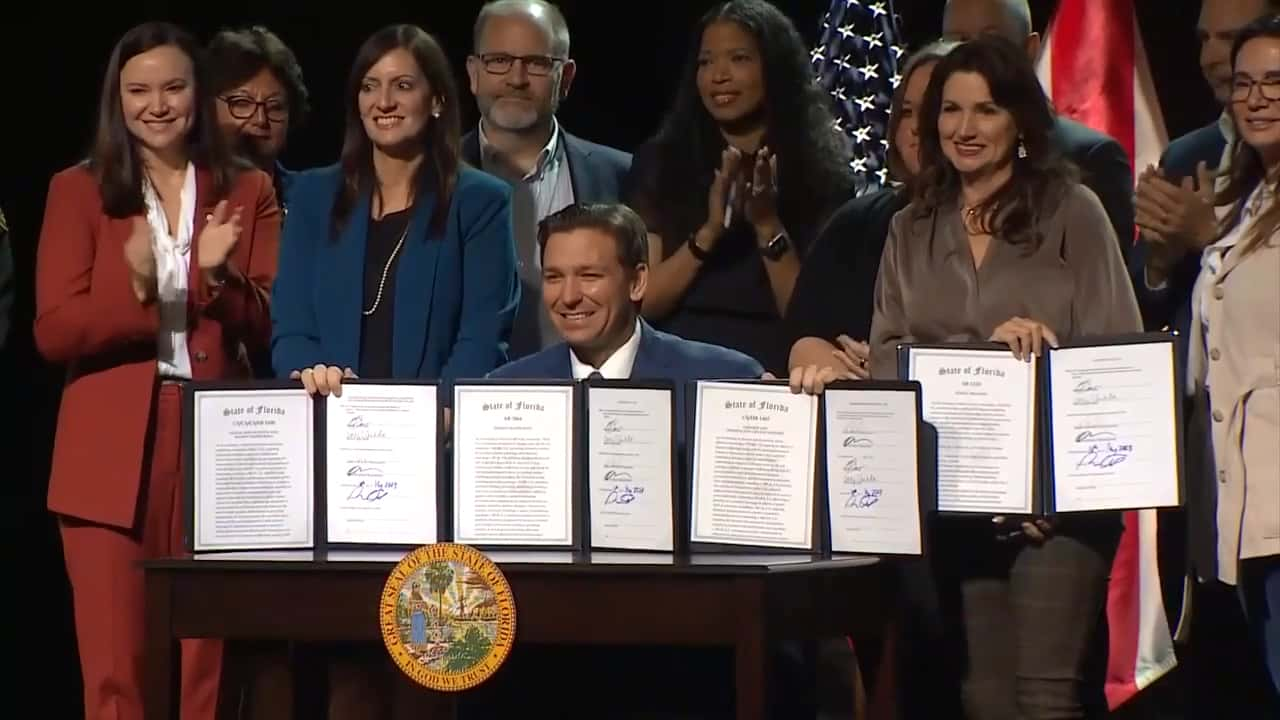

However, he did sign a law prohibiting the investment of public funds into environmental, social, or governance (ESG) funds. DeSantis criticized the practice, referring to it as a way to utilize pension assets for political purposes. He mentioned that they had shifted $2 billion away from BlackRock, an activist asset manager, into other investments.

While other governors have made similar moves, a bill passed in Tallahassee could allow even more pension funds to be allocated to higher-risk investments with potential political connections. Critics argue that this poses a long-standing problem, with the only difference being the scale of the portfolio.

READ ALSO: Local Nonprofit Organization Provides Food Relief To More Than 300 Georgian Families