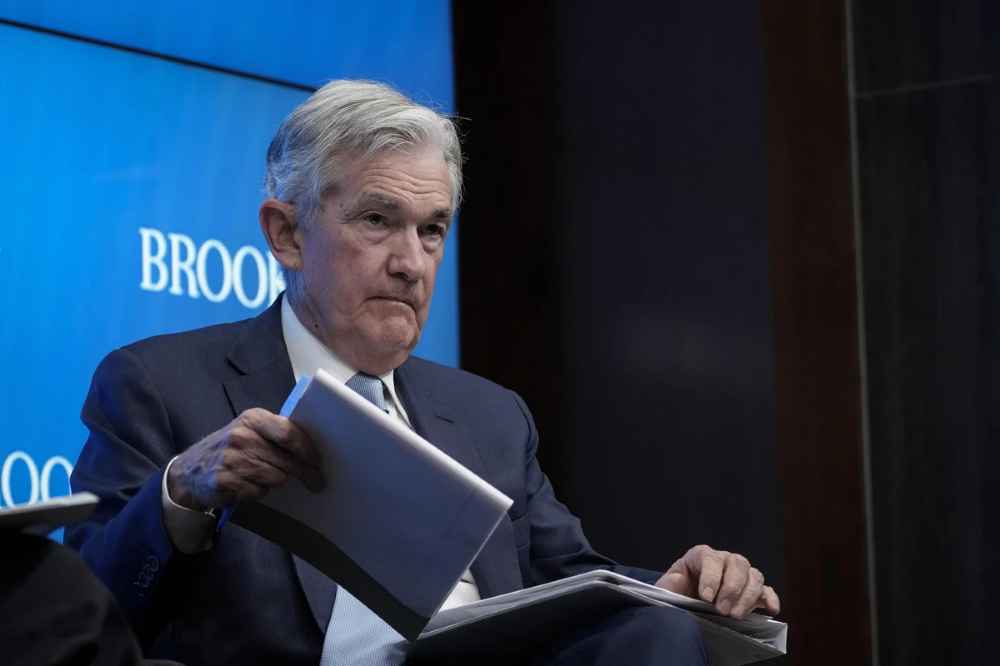

Fed Chair Jerome Powell emphasized the necessity of “below-trend growth” in his recent remarks at the Kansas City Fed’s economic symposium, cautioning that persistent “above-trend growth” could trigger further monetary policy tightening.

Fed Chair Jerome Powell sees signs of a cooling US job market, aligning with the Federal Reserve’s quest for weaker job creation and a demand slowdown to combat inflation

The latest Labor Department report for August provides some respite for Fed Chair Jerome Powell’s concerns. Unemployment has risen to 3.8% from July’s 3.5%, indicating a reduction in economic demand, which could help alleviate price pressures. Robust demand typically prompts employers to raise wages, potentially leading to higher costs for consumers.

Average hourly earnings grew by just 0.2% monthly and 4.3% annually in August, down from July’s 0.4% and 4.4%. Job openings fell below 9 million, and the rate of people quitting returned to pre-pandemic levels. Temporary jobs decreased by 19,000, while the average workweek inched up.

Although the US economy’s pace slowed in the second quarter, consumer spending saw a significant boost in July

Despite interest rates at a 22-year high, Fed Chair Jerome Powell is expected to pause rate hikes later this month due to the job market and broader economic moderation.

Economists believe the Fed Chair Jerome Powell’s job market is transitioning from a sprint to a marathon, with welcomed slowing growth and no imminent recession in sight. However, uncertainties remain, such as the impact of Fed Chair Jerome Powell’s previous rate hikes, student loan repayments resuming, and potential shifts in consumer spending. Businesses may also address staffing shortages as recession fears wane, leading to renewed growth opportunities.

READ ALSO: Menasha Police Department Launches Innovative Community Camera Program For Enhanced Safety