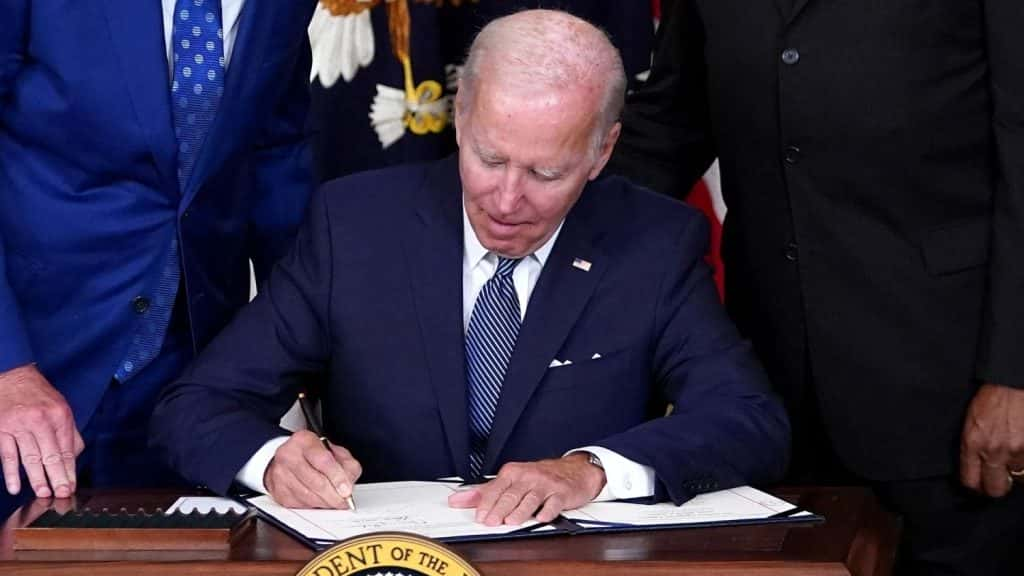

Several eligible recipients will get relief under the Inflation Reduction Act.

Eligible Recipients Will Get Tax Breaks and Several Reliefs Following the Passing of the Inflation Reduction Act

After passing the Inflation Reduction Act, several eligible recipients expect tax breaks and various reliefs to help them meet their needs, especially to pay their bills and other expenses.

The Inflation Reduction Act will allow eligible recipients, especially Medicare beneficiaries, to receive benefit expansion for vaccines and medicines while others will receive higher tax credits, which will help them more amidst the inflation.

According to the act, the eligible recipients will also receive tax cuts, tax breaks, and expanded tax assistance that will give relief for more than 10 years, USA Today reported.

READ ALSO: IRS Reminds Taxpayers Of Home Energy Tax Credits For Energy Efficient Updates

Some Taxpayers Will Expect Tax Increases Following the Approval of the Inflation Reduction Act

While eligible recipients will get some relief and funds, other taxpayers who own corporations and large businesses will have tax increases, but small businesses and families who are making below $400,000 annually will not be affected by the tax increase.

Under the Inflation Reduction Act, affected large corporations and businesses will have higher tax increases while eligible recipients, including low-income families in need, will be given relief and funding for their expenses.

READ ALSO: Property Tax/Rent Rebate Program To Expand Relief To Over 170,000 Eligible Pennsylvanians