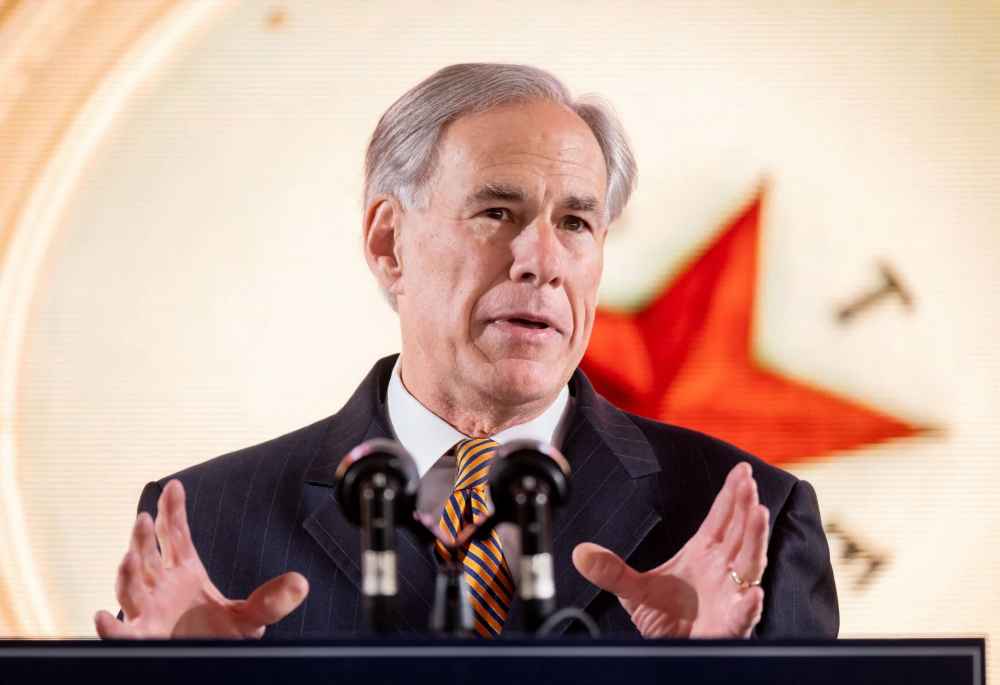

The idea, initially proposed by an influential conservative think tank, has gained traction, supported by Governor Greg Abbott, who emphasized Texans’ desire to own their property instead of renting it from the government.

The debate over property taxes in Texas has taken center stage in the current legislative tax cut discussions, with the question of whether it’s possible to eliminate school property taxes altogether

However, opposition has also emerged, including concerns from school districts about the loss of financial independence if the reliable source of local tax collection is removed. Lieutenant Governor Dan Patrick has criticized the notion, highlighting the complexities of funding schools in Texas.

State leaders have planned to allocate at least $12.3 billion for new property tax cuts, regardless of the final agreement reached. The substantial state surplus of $32.7 billion this year allows for these tax cuts while still increasing per-student funding over the next two years. Nevertheless, concerns persist about the potential long-term impact on school districts if property taxes are gradually reduced or entirely phased out.

Efforts to address the issue of property taxes in Texas have been complicated due to the local nature of tax levies and the limited alternative sources of revenue

School taxes account for the largest portion of property tax bills, and the maintenance and operation taxes make up a significant share of those. The state has attempted to address funding disparities between property-rich and property-poor districts by redistributing funds. However, property tax rates in Texas remain among the highest in the country, as the state lacks a state income tax to support education.

Various proposals have been made in the past to reduce property taxes, such as replacing them with an expanded sales tax, but they have not garnered sufficient support. In 2019, surplus funds were used to compress school maintenance and operation taxes, stabilizing rates and addressing equity issues. However, unexpected property value increases during the pandemic resulted in less relief than anticipated.

READ ALSO: Harris County Launches Early REACH Program To Address Day Care Shortage