American Taxpayers who would also claim Earned Income Tax Credit or Additional Child Tax Credit have to wait up to four weeks to get a tax refund via paper check or direct deposit once the tax return is approved by the IRS.

Earned Income Tax Credit or Additional Child Tax Credit Refund Date Details!

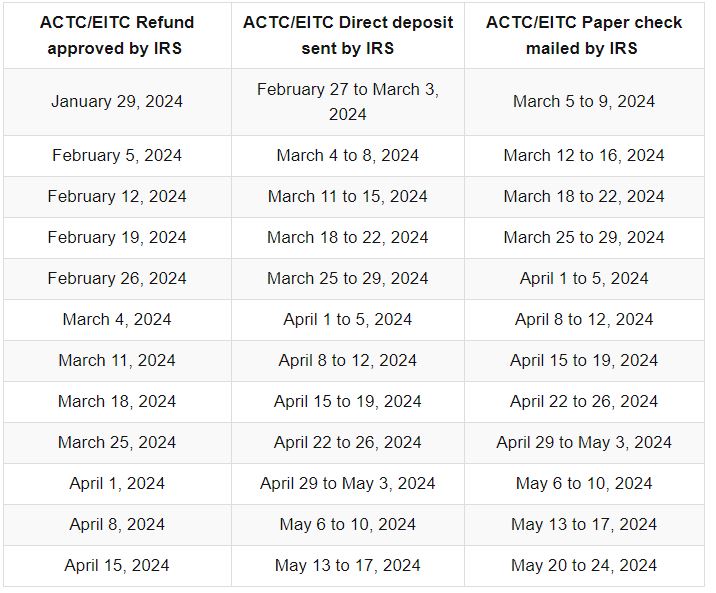

The IRS is about to release the Earned Income Tax Credit or Additional Child Tax Credit Refund to claimants as early as February 27, 2024. On this day, only those American taxpayer’s refunds will be sent, who have filed for a tax return in the early stage, and a tax refund was approved by the agency on or before January 29, 2024, based on your tax return approval date.

Check the date to get your Earned Income Tax Credit or Additional Child Tax Credit refund from the chart below. Tax refunds for Earned Income Tax Credit or Additional Child Tax Credit recipients will be released by the agency between the below-mentioned estimated dates.

Read Also: Credit For Caring Act: A $5,000 Tax Credit Plan That Might Benefit Million Americans

Earned Income Tax Credit or Additional Child Tax Credit Refund Status and Delay Payment

Refund status for Earned Income Tax Credit or Additional Child Tax Credit can be tracked using the Internal Revenue Service’s ‘Where’s My Refund’ toll or ‘IRS2GO’ mobile application.

To check the refund status, you have to go through the step-by-step instructions below:

First, Go to the IRS’s webportal, which is accessible at irs.gov/, and look out for an option of ‘Tax Return Status’ and hit on it to access the ‘Where’s My Refund’ toll.

Additionally, you need to enter your SSN, Tax Year, Refund Amount, and Filing Status and hit the Submit button. Once you have gone through the step-by-step instructions above, you will successfully have tracked your tax return status.

The Earned Income Tax Credit or Additional Child Tax Credit Refund payment takes up to 4 weeks to process if you receive a refund.

Read Also: Tax Season 2024: Frugal Tips To Maximize Your Money And Ease Financial Stress