Tax returns can be confusing, especially with IRS codes. This guide decodes several frequent transaction codes on tax refunds and explains their meanings.

Understanding Transaction Codes: Tax History Roadmap

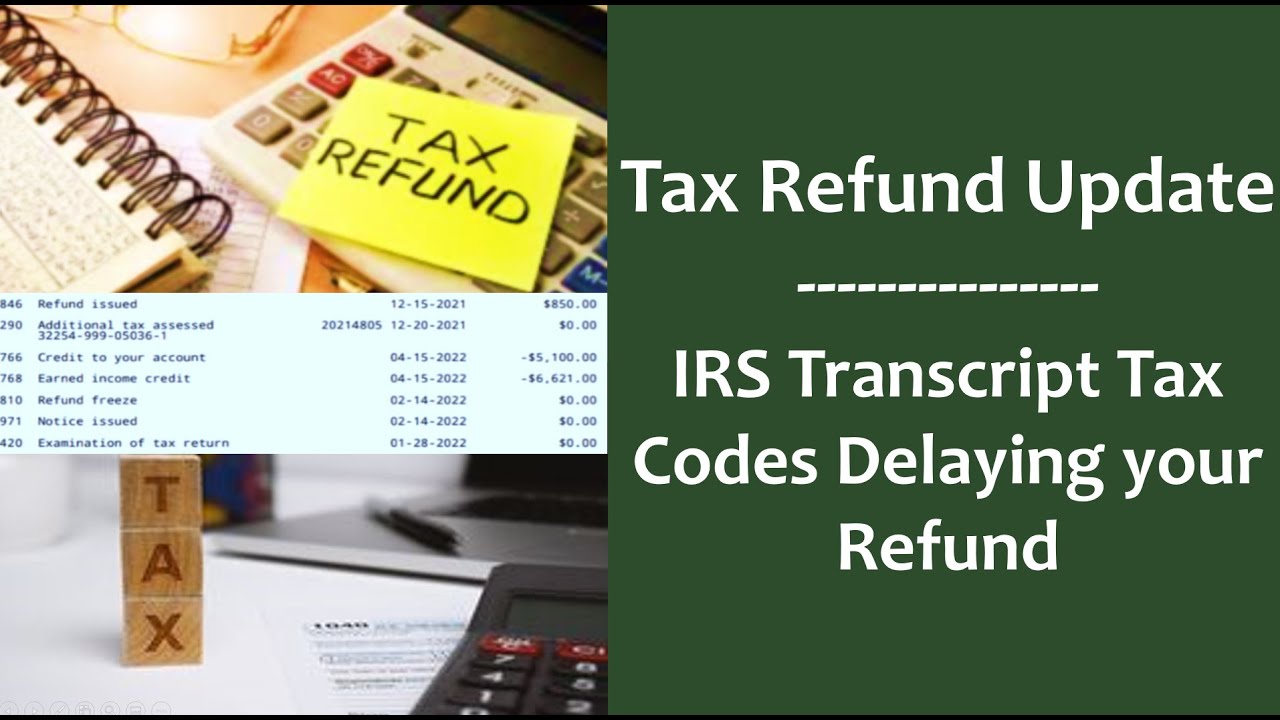

Three-digit codes indicate IRS tax credits and debits. When reversed, these codes, with an “R,” reflect your account history. Let’s examine the relevance of some tax season codes.

IRS code 826 indicates that part of your tax refund was used to pay off a debt. This transaction code shows how the IRS applies your refund for debt clearance.

IRS code 846 indicates success. This transaction code means the IRS approved your return, including interest. It’s approval for your funds.

Code 570 warns. This transaction number indicates a hold on your account, preventing refunds. The IRS may need more information before proceeding, so be patient.

Code 971 is used when the IRS needs extra information, often related to a Code 570 hold. It emphasizes your participation in supplying the details required.

The IRS has many more codes than those highlighted. 000, 011, 013, 017, 091, 150, 177, 424, 425, 766, 768, 810, 811, and 9001 have different meanings. Code 150 creates a Master File Entity with assessed tax liability from your return.

READ ALSO: Verizon Stirs Controversy: Aggressive $4 Price Hike Sparks Backlash from Subscribers

Tax Season with Confidence

These transaction numbers guide you through IRS actions, requests, and approvals. We’ve focused on deciphering standard codes, but the IRS website offers a complete list.

Finally, this will help you understand IRS transaction codes that define your tax narrative. With this knowledge, you may confidently prepare your tax return during tax season.