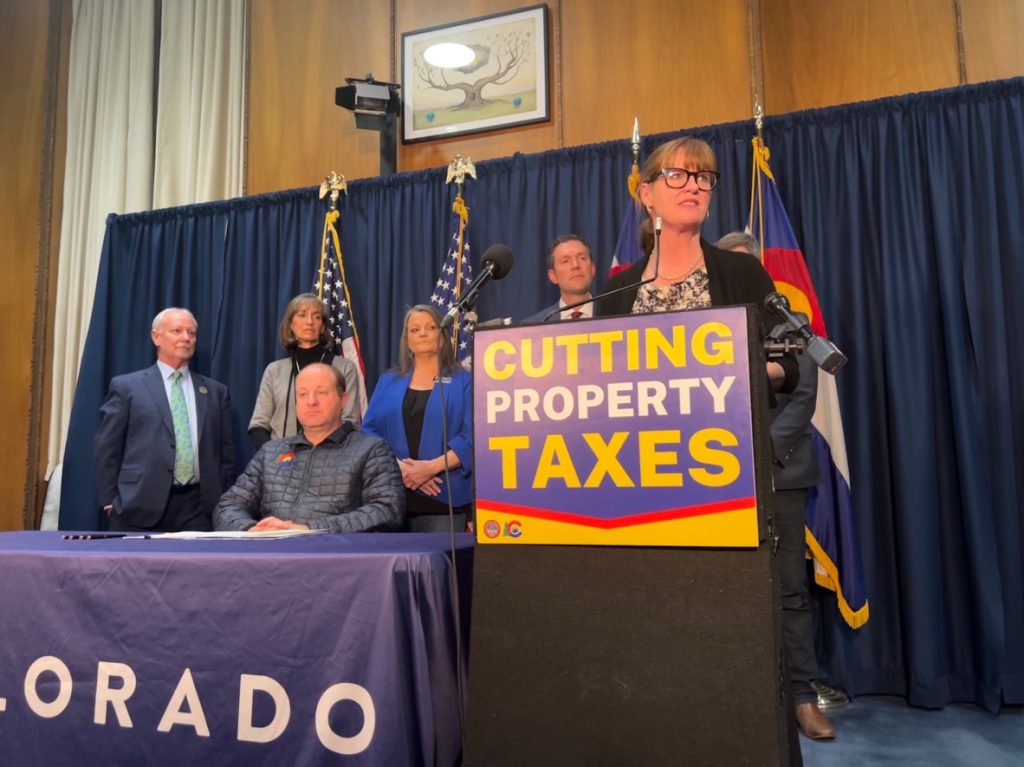

In a positive move for Coloradoans, the state legislature passed several bills in November, with a particular focus on aiding older adults and homeowners. The changes include adjustments to the residential assessment rate, an increase in emergency rental assistance, and modifications to tax credits. These measures aim to provide financial relief and support to various segments of the population.

Homeownership Benefits and Tax Adjustments

Two key initiatives bring relief to homeowners, altering the residential assessment rate from 6.75% to 6.765% for the 2023 tax year. While seemingly small, this change allows homeowners to exempt $55,000 of their home’s value, in addition to the $200,000 exemption for those eligible for the Senior Homestead Exemption.

Additionally, all taxpayers, aged 18 and over, will receive $800, reminiscent of previous Tabor refunds. The schedule for applying for Tabor refunds is yet to be announced, ensuring financial assistance to a broad spectrum of individuals, with higher amounts for low-income earners.

Another significant development involves increasing emergency rental assistance to $95 million until June 30, 2024. Eligible individuals making less than 80% of the area median income can access support for rent, utility bills, legal fees, and eviction prevention costs.

READ ALSO: Arkansas had 35.6 mortgage refinances per 1,000 households in 2022, below the national average.

Tax Credit Boost and Long-term Property Tax Plan

A 50% boost in the state’s earned income tax credit would help grandparents raising their grandkids regardless of custody. Currently, the credit is only 25%. The goal of this modification is to lessen the financial strain that comes with providing care.

In a forward-looking approach, the legislature established a task force, led by Senator Chris Hansen, to develop a long-term property tax plan. Older adults are encouraged to participate, with the Colorado Gerontological Society facilitating collaboration between policymakers and the community. The society invites active engagement from all concerned parties in shaping future property tax policies.