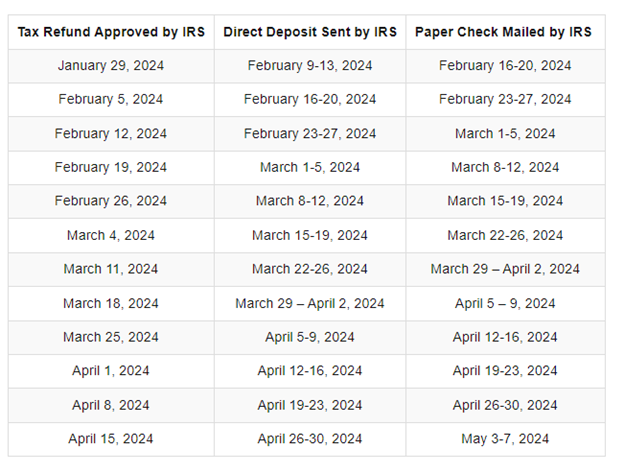

The Internal Revenue Service (IRS) has started approving rebates for tax year 2023 from January 29, 2024. Those whose returns have been approved can check the IRS Payout Schedule by checking the refund status, and this article also has shared the IRS Payout Schedule to get a refund.

IRS Payout Schedule 2024

If you are one of the millions of American taxpayers who have filed electronically to receive a tax refund and now want to know the date to receive your refund and know the IRS Payout Schedule, let us tell you that according to the IRS, 90% of refunds that are filed electronically are received within 21 days whether they have chosen for direct deposit or paper check for payout.

Based on the tax return approval date, you may check the IRS Payout Schedule to get the refund via direct deposit or paper check from the table below.

IRS Payout Schedule on EITC/ACTC

Taxpayers who also have claimed an Earned Income Tax Credit (EITC) or Additional Child Tax Credit (ACTC) will get the tax refund as early as February 27, 2024, you may check the complete schedule of getting the tax return with EITC/ACTC from the table below.