Two bills aimed at expanding California’s tax credits have been authored by Democratic Assembly members Mike Gipson and Miguel Santiago.

The first of the California Bills, AB 1498, would raise the minimum credit of the Earned Income Tax Credit to $300 from $1

As long as the recipient earns less than $30,000 per year, the number of dependents is not taken into consideration. The second bill, AB 1128, would permit tax filers to continue qualifying for the Young Child Tax Credit after their youngest child ages past 6. These families will retain the child tax credit until the child reaches 18, or 23 if they are a student. Families with dependents with disabilities would also be eligible for the young child tax credit, regardless of their dependent’s age.

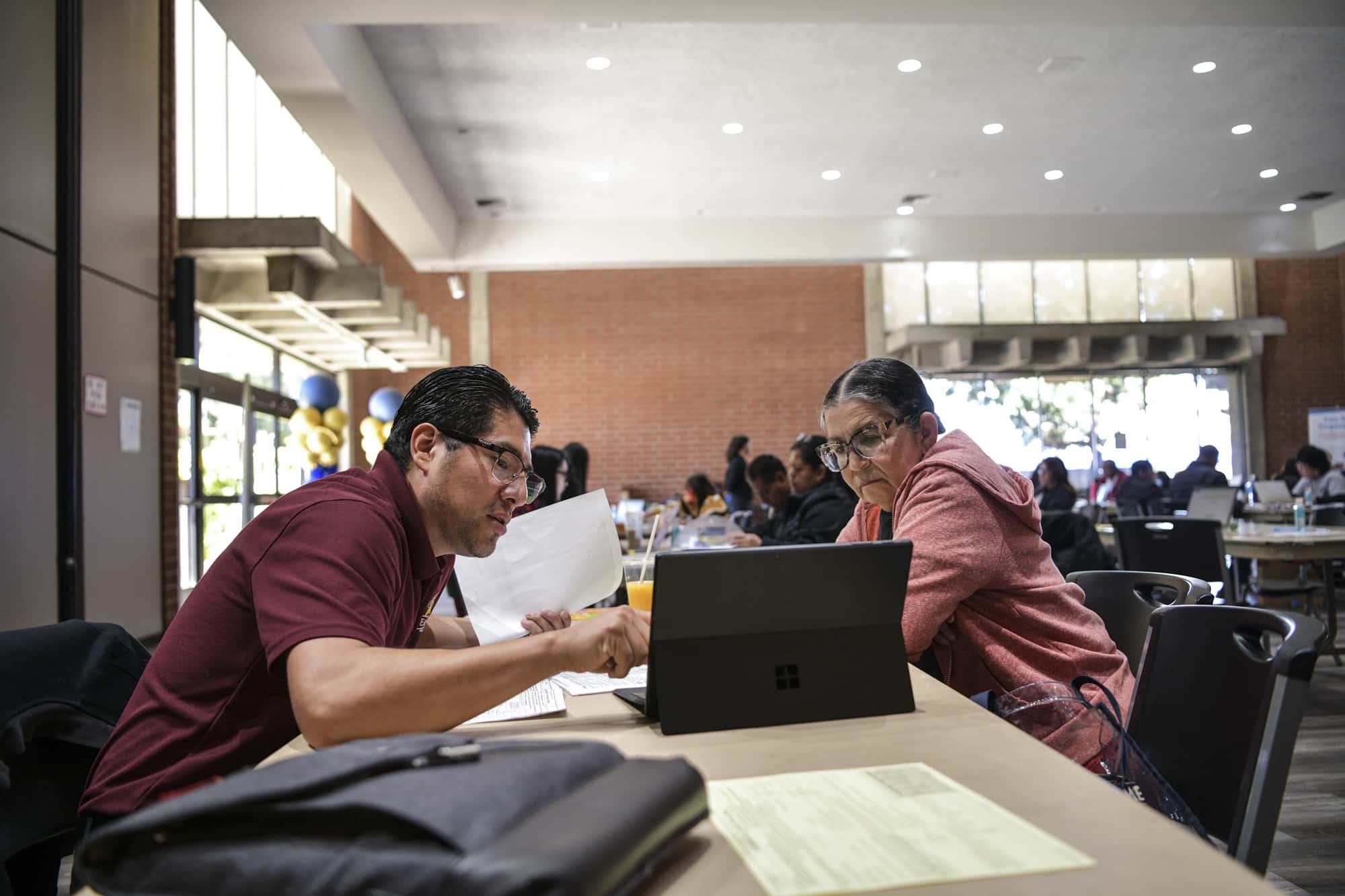

California’s tax credits are increasingly essential, according to advocates, as low-income families struggle to recover financially from the pandemic while other government relief programs expire. Reyna Bonilla, who lost her job cleaning hotel rooms in 2020, utilized tax credits and other pandemic relief to catch up on past-due rent so she and her two children could stay in their Los Angeles apartment. However, things have changed this year, with Bonilla only making about $10,000 annually from cleaning homes a few days a week. Most of her pandemic aid has phased out, leaving her struggling to cover expenses. Additionally, her youngest child turned six in November, making her ineligible for California’s Young Child Tax Credit. Her tax refund will be $1,083 less this year, adding pressure to her tight budget.

The Federal Government expanded its tax credits in 2020 to send advanced monthly payments to low-income families with children, which included very low-income earners for the first time, thereby reducing child poverty. However, the credit expansion ended in December 2021. Gipson and Santiago’s bills aim to expand the Earned Income Tax Credit and the Young Child Tax Credit to fill the gap left by the ending of the Federal Government’s tax credits.

The two bills are estimated to cost $1.1 billion annually at a time when the state is anticipating a $22.5 billion to $25 billion deficit

The California Earned Income Tax Credit currently gives credits of $1 to about $3,400 to tax filers who earn as much as $30,000 in annual income, with the impact being modest. For example, about 83% of those filers got less than $300 in state tax credits in 2022. AB 1498 would raise the minimum credit to $300 from $1, with no regard for the number of dependents, as long as the recipient makes less than $30,000 annually. AB 1128 would enable tax filers with dependents who also qualify for the state Earned Income Tax Credit to continue qualifying for the Young Child Tax Credit after the youngest child ages past 6.

Gipson says the Earned Income Tax Credit does not go far enough, particularly in the economy they find themselves. The state-earned income tax credit is structured to provide an incentive for people to work, so it phases in more cash as earned income increases to $30,000. However, this targets working individuals with dependents who are most in need, leaving out many people who can’t work because they care for loved ones and single filers who don’t have dependents but struggle to get by. Teri Olle, the California Campaign Director of the Economic Security Project, says the need for lower-income tax credits is as dramatic as ever, with high gas and food prices, a higher cost of living, and nothing to support many people.