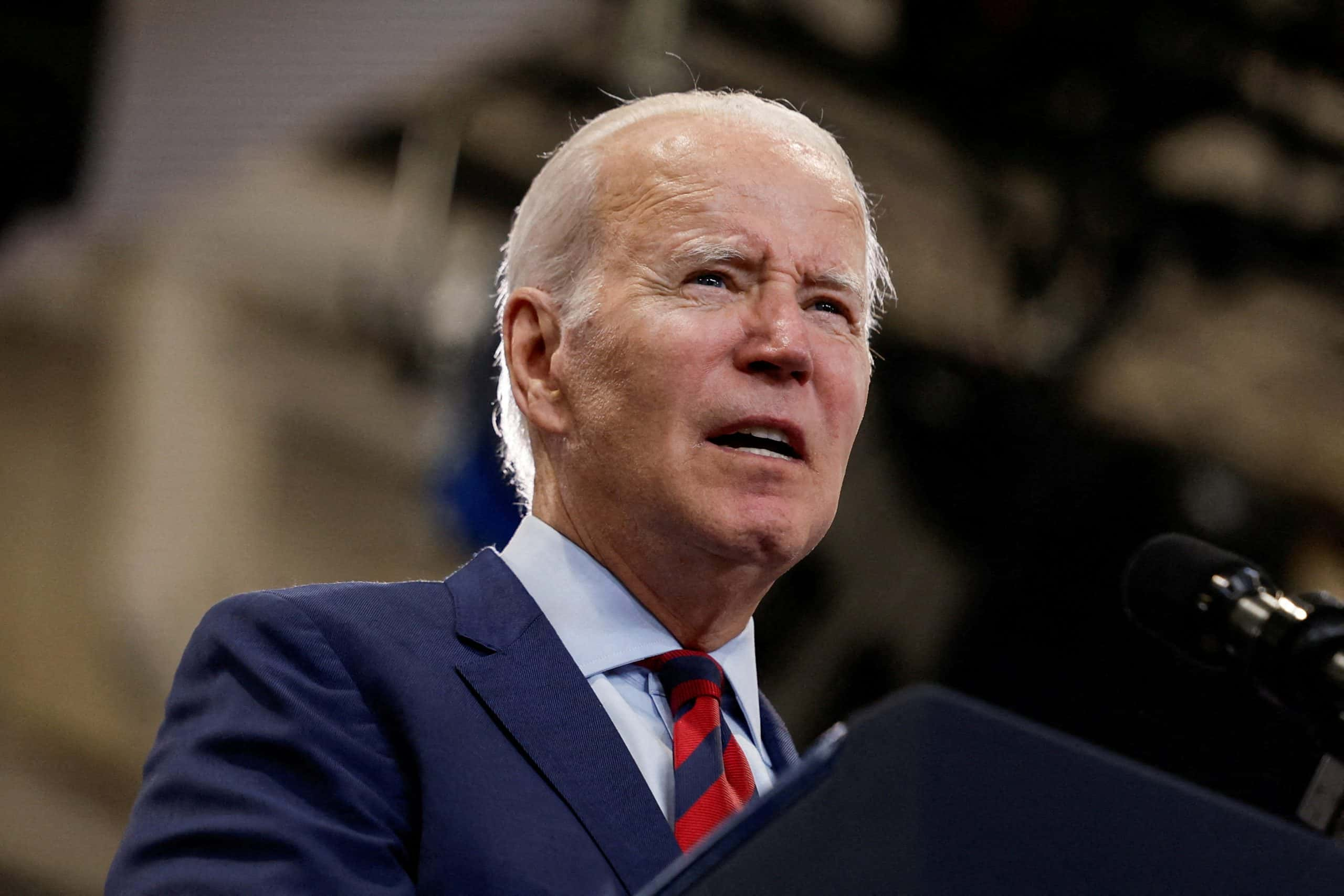

President Joe Biden’s pledge to forgive up to $20,000 of each borrower’s federal student loan debt may soon expire if the United States. The Supreme Court will, as anticipated, reject the proposal this month. If the idea is turned down, many borrowers might be forced to file for bankruptcy, claims at least one legal professional.

Debt Defaults Demonstrate The Need For A Plan To Help Borrowers Pay Off Debts

The reason is simple: Many borrowers won’t have enough money when federal student loan payments start this summer after a vacation of more than three years.

20% of student loan borrowers have previously defaulted on a loan, according to Jonathan Petts, CEO of Upsolve, a nonprofit organization that helps people file for bankruptcy without engaging a professional attorney. Debt defaults of over $124 billion have already occurred.

In an email to GOBankingRates, Petts stated that this “demonstrates a clear need for a plan to help borrowers facing challenges with paying off their debts.”

READ ALSO: Bidens Plan To Eliminate Gasoline-powered Cars And Make The Economy More Dependent On China

Bankruptcy Can Be An Alternative To Debt Relief

He asserted that the Biden proposal for forgiveness is “likely to be struck down” by the Supreme Court, which suggests that loan payments and interest will resume shortly after.

According to Petts, many customers may be eligible to use bankruptcy as an alternative to debt relief.

Before considering filing for bankruptcy, you must be aware of the rules governing federal student loans. You can have your federal student loan discharged in bankruptcy “only if you file a separate action” called an “adversary proceeding,” in which you ask the bankruptcy court to find that repayment would put you and your dependents through an undue hardship.

Federal Student Aid claims that there isn’t a single guideline used by bankruptcy courts to determine what constitutes an undue burden. To determine whether requiring you to repay your loans would place an unreasonable burden on you, they may, however, take into account the following factors:

- If you had to pay back the debt, you wouldn’t be able to support yourself.

- There is evidence that this problem will persist for a significant portion of the loan repayment period.

- You genuinely tried to repay the money before filing for bankruptcy.

It used to be almost impossible for the majority of borrowers to be eligible for a bankruptcy discharge. Despite this, the U.S. The Department of Justice has established a “fairer and more accessible” bankruptcy discharge process for those who have student loan debt.

The new process provides Justice Department attorneys with “clear standards” to apply when recommending discharge to the bankruptcy judge without necessitating “unnecessarily burdensome and time-consuming” investigations, according to a news release from the DOJ dated November 17, 2022.

According to the press release, the new process will make it simpler for debtors who previously questioned if bankruptcy might be able to give them relief to figure out whether they are eligible for a discharge.

For students who are struggling financially, Petts claims that the lax rules make it far simpler to discharge their student loan debts through bankruptcy.

He asserted that the Department of Justice had fundamentally altered how it assesses “undue hardship” for those declaring bankruptcy in order to determine whether to also discharge student loans. It will now be less complicated for many people to file for Chapter 7 bankruptcy and have their student loan debt discharged at the same time.

READ ALSO: Refinancing Loans And Joining The Gig Economy Can Help Reduce Student Debt