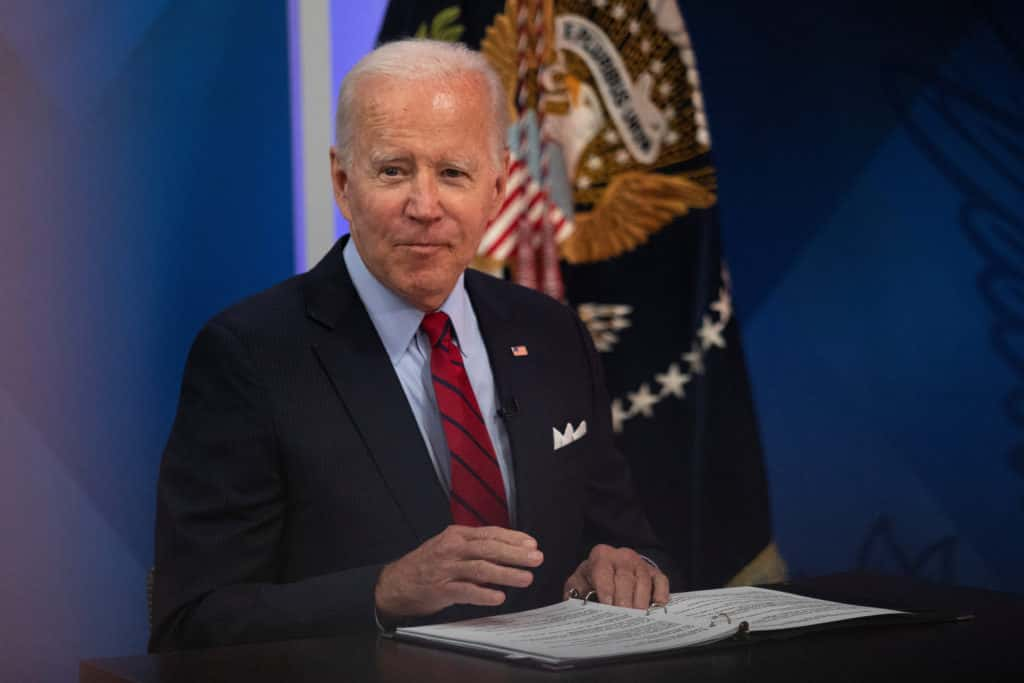

The Biden student loan program aims to rectify past servicing errors and accurately count the number of payments that qualify for loan forgiveness under income-driven repayment (IDR) plans.

Approximately 2,580 federal student loan borrowers in Rhode Island are set to benefit from the Biden student loan debt relief initiative

The Biden student loan relief measures are expected to result in $109 million in IDR forgiveness for Rhode Islanders. The White House projects that these corrective actions will eliminate a staggering $39 billion of federal student debt for over 800,000 borrowers across the nation.

Senator Jack Reed emphasizes the need for targeted relief for Rhode Island student loan borrowers. He urges Congress to collaboratively address the underlying issue of college affordability. The Senator applauds the Biden Administration’s efforts to correct systemic failures that have prevented borrowers from receiving rightful debt cancellation, stressing that this initiative aims to correct past injustices caused by federal loan servicers’ errors.

The Biden Administration is committed to resolving the historical mismanagement of the Biden student loan program. The recent 6-3 U.S. Supreme Court decision striking down a Biden student loan forgiveness measure has further emphasized the importance of these corrective actions.

The U.S. Department of Education has announced the Saving on Valuable Education (SAVE) plan, a new IDR program

The SAVE plan will determine a borrower’s monthly student loan payment based on their income and family size, potentially reducing the required payment by half for those with undergraduate degrees. The Biden student loan program is set to begin in the fall, fully operational by July 2024, and is expected to save student loan borrowers thousands of dollars over the life of their loans.

To qualify for the SAVE repayment plan, borrowers must have federally held student loans, including Direct subsidized, unsubsidized, and consolidated loans, as well as PLUS loans for graduate students. Notably, private student loans are not eligible for the SAVE plan or any other federal repayment program.

The Biden student loan initiatives seek to alleviate the burden of student loan debt, making higher education more accessible and affordable for borrowers across the country.

READ ALSO: Shakira Isabel Mebarak Ripoll Faces Second Tax Fraud Investigation Amid Ongoing Legal Battle