The Biden administration has introduced a new repayment plan for student loans, known as the SAVE Plan, which is set to become the next battleground in the legal fight over student loan relief.

The Biden plan offers lenient terms, with interest not accumulating as long as regular payments are made

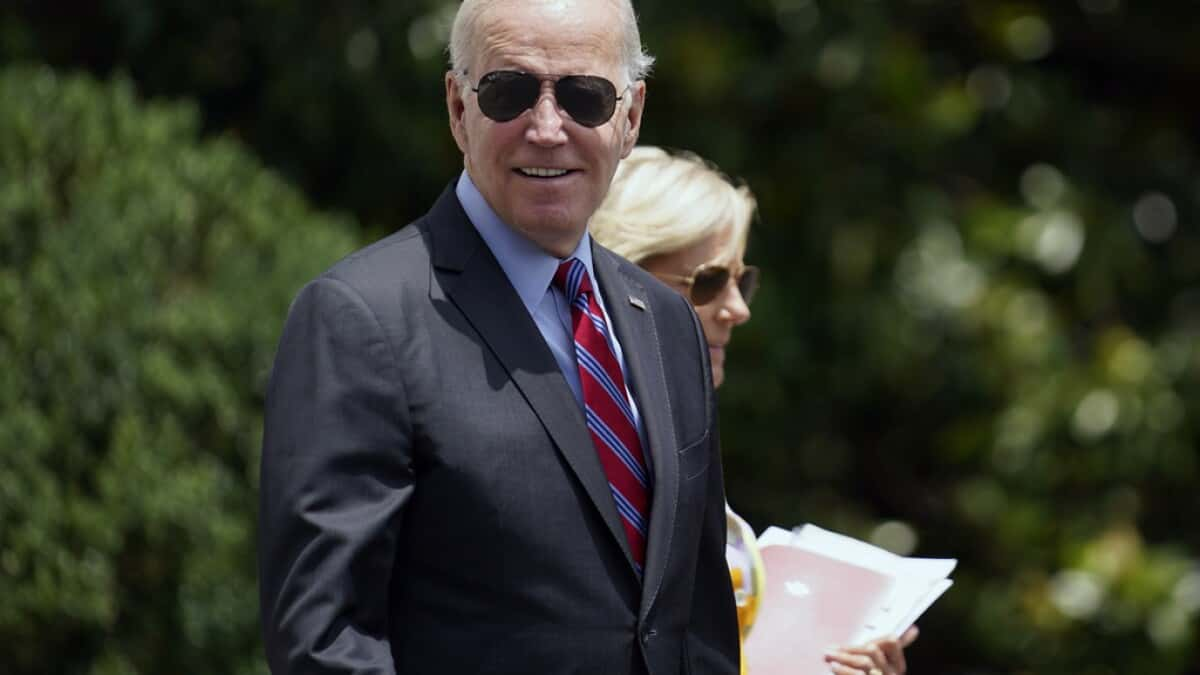

It also reduces monthly payments to $0 for millions of borrowers and cancels any remaining debt within 10 years. While President Joe Biden‘s proposal for mass student loan cancellation has been overshadowed, the Supreme Court’s rejection of the forgiveness plan has shifted attention to the SAVE Plan. Biden’s plan has emphasized that it is the most affordable repayment plan ever, highlighting that the average borrower will save $1,000 per month.

Opponents, mainly Republicans, argue that the Biden plan exceeds the president’s authority. They claim it is unfair to the majority of Americans without student loans. The Congressional Budget Office estimated that the plan would cost $230 billion over a decade, but with the forgiveness plan struck down, the cost is expected to be even higher, reaching up to $361 billion according to researchers at the University of Pennsylvania.

Critics emboldened by the Supreme Court’s decision foresee a potential legal challenge to the Biden plan in the future

The Biden plan is intended to replace existing income-driven plans, offering reduced payments based on income and family size. Notable changes include eligibility for $0 payments for those earning less than 225% of the federal poverty line, preventing interest accumulation, capping undergraduate loan payments at 5% of discretionary income, and providing a quicker path to loan forgiveness starting in July 2024.

The Education Department will notify borrowers of the new application process, and those enrolled in the existing REPAYE plan will be automatically transferred to the SAVE plan. Proponents argue that the Biden plan simplifies repayment options and provides relief to millions of borrowers. However, opponents view it as an unfair perk that passes the cost onto taxpayers who have already repaid their loans or did not attend college. Some express concerns that it may incentivize colleges to raise tuition prices. Critics also claim that the Biden plan is an attempt to provide free college without Congressional approval.

While the Biden Plan has finalized the rule for the SAVE Plan, critics argue that it exceeds the administration’s legal authority and expect a legal challenge to arise, potentially leading to further debate over the plan’s legitimacy.

READ ALSO: New Enrollment In Biden’s Student Loan Forgiveness Plan Offers Relief For Borrowers