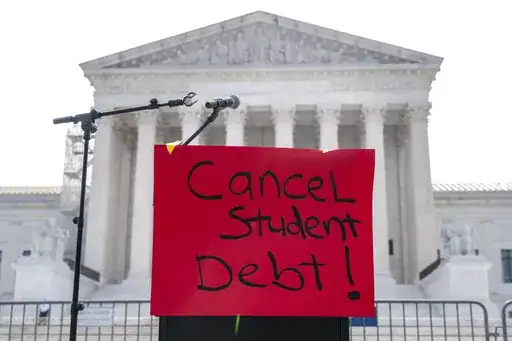

When the Biden administration declared Friday that it will erase $39 billion in student debt for 804,000 students, many of them may have expected that the project would suffer the same destiny as the Supreme Court’s decision to kill the student loan forgiveness program last month.

Experts on student loan forgiveness believe that this one will survive.

How are the two loan forgiveness actions different?

The present student loan forgiveness gauge is not the same as the White House’s broader debt-cancellation scheme, which was rejected by the Supreme Court in a 6-3 decision on June 30. Tens of millions of individuals would have had up to $20,000 in federal student debt forgiven as a result of this action. It was estimated that it would cost $400 billion.

Depending on the plan, IDR plans cap monthly payments at 10% or 20% of a household’s discretionary income. The United States Department of Education is attempting to implement a new plan with a 5% cap.

Importantly, borrowers who make regular payments for a period of 20 or 25 years have their remaining loan sums eliminated.

However, the Biden administration stated that, despite the fact that debtors had earned it, student loan forgiveness had not occurred in many cases due to administrative errors.

Beneficiaries of the new student loan forgiveness program will have their debt wiped automatically in the coming weeks, according to the Department of Education.

The recent plan has a different legal precedent.

Some politicians questioned the legality of the latest student loan forgiveness plan last week.

Rep. Virginia Foxx, R-North Carolina, leader of the House Committee on Education and the Workforce, for example, said the Biden administration was “trampling the rule of law” and attempting to “circumvent” the Supreme Court’s recent order on loan forgiveness.

Experts say the two actions are based on distinct legal precedents.

“The two programs have nothing to do with one another,” said attorney Abby Shafroth, co-director of advocacy and director of the National Consumer Law Center’s student loan borrower support program.

The Heroes Act of 2003 served as the foundation for President Joe Biden’s expansive — and now-defunct — student loan forgiveness plan announced in August 2022. During national emergencies, this statute provided the president the authority to amend the student loan forgiveness plan.