Advocating for a Permanent Child Tax Credit 2024

Addressing Economic Strain and Rising Costs

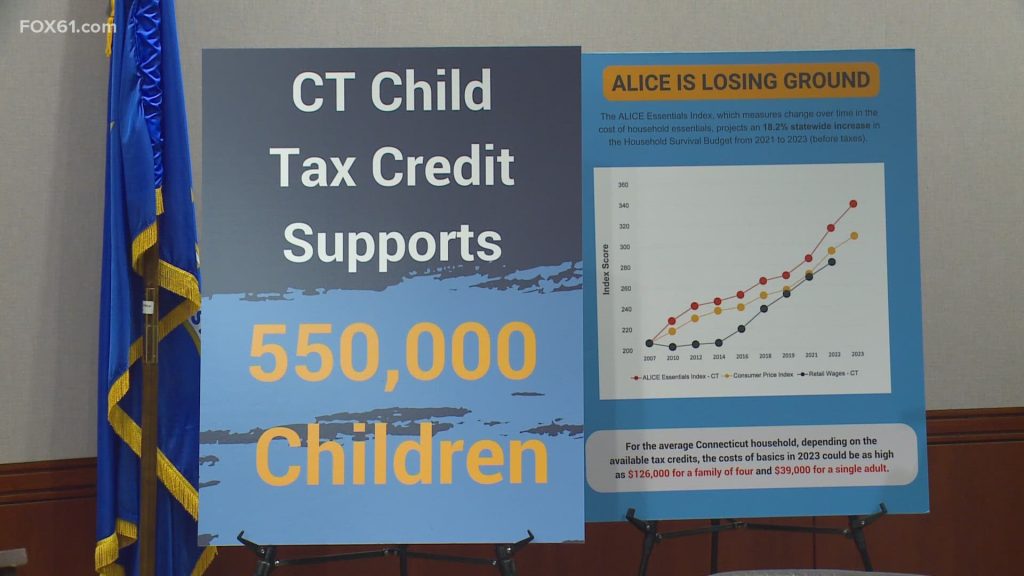

According to CT, the Connecticut Nonprofit Child Tax Credit Coalition, alongside lawmakers, nonprofits, and families, convened at a news conference to advocate for a permanent fully refundable child tax credit 2024. The proposed credit would provide families with $600 per child annually aiming to mitigate child poverty and foster a more equitable tax system. With 39 percent of Connecticut families struggling to make ends meet according to the Connecticut United Way, the urgency for such support is palpable. Lawmakers emphasized the pressing need for a child tax credit 2024, particularly as essential costs surged by 18 percent over the past two years due to inflation. Jessica Chubbuch, a single parent, underscored the challenges faced by many families noting the impact of rising costs on their ability to provide for their children. With the proposed child tax credit 2024 families like Chubbuch’s hope for relief with funds directed towards groceries, gas, and other essential expenses.

READ ALSO: State-Based Child Tax Credit 2024 In Connecticut Is Up Against Opposition As The Funding And Benefits Debate Faces An Uphill Battle!

Strong Legislative Support for Child Tax Credit 2024

The proposed child tax credit 2024 garnered substantial support with dozens of lawmakers attending the press conference to express their backing. Advocates stressed the potential impact on various communities highlighting statistics showing the positive effects on Asian, Black, and Latino families in Connecticut. As discussions continue among lawmakers, the momentum behind the push for a permanent child tax credit 2024 remains strong signaling a concerted effort to address economic strain and promote financial stability for Connecticut families.