IRS Payout Schedule will give a refund at post-filing in around 21 days. Particularly, opting for electronic filing considerably accelerates the processing timeframe compared to traditional paper submissions.

IRS Payout Schedule 2024

According to the IRS, there are specific factors affecting the timing of tax refunds, such as but not limited to the typical turnaround time for getting a tax refund after filing is approximately 21 days; and electronic filing significantly reduces processing times compared to paper submissions.

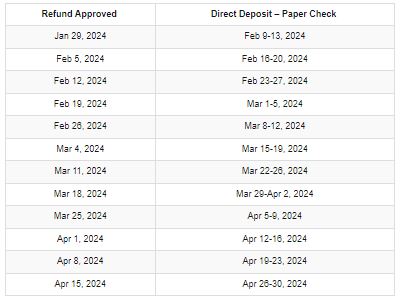

Taxpayers of the Earned Income Tax Credit and Additional Child Tax Credit will meet a mandatory waiting for the IRS Payout Schedule, during which their tax refunds must remain held by the IRS until mid-February, resulting in the receipt of these tax funds around the IRS Payout Schedule of February 27, 2024. See the IRS Payout Schedule 2024 below!

Factors Affect IRS Refund Timing during IRS Payout Schedule

- Filing Method- Electronic Filing is faster than Paper Filing.

- Complexity of Your Return- either simple returns or complex returns.

- Errors on your Tax return before and after the IRS Payout Schedule.

If your tax return has been processed, you’ll see a message indicating whether your refund has been approved, sent, or is still being processed. You can get it on the IRS Payout Schedule.

Read Also: Stimulus Checks 2024 Worth $550 From $1b Pot Releasing Out Now: See If You Are Eligible!