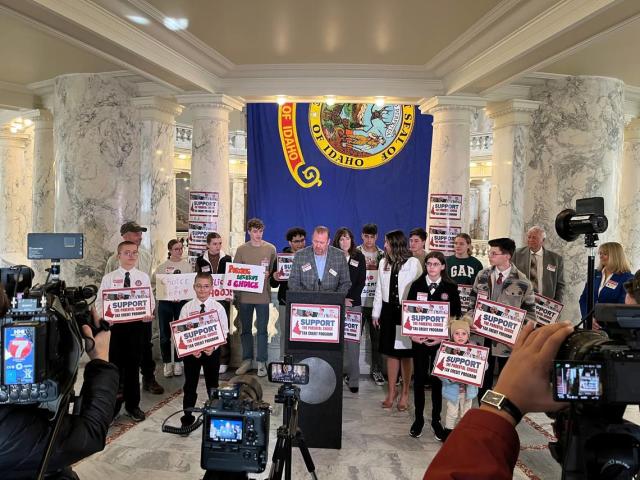

In a renewed effort, Idaho Republican lawmakers introduce a proposal to enable schoolchildren in the state to use public funds for education expenses outside the public school system. Following last year’s unsuccessful attempt to implement education savings accounts, the new proposal suggests a tax rebate system. Amidst a gathering of parents and students advocating for school choice at the Idaho Capitol, Sen. Lori Den Hartog and Rep. Wendy Horman present the bill, aiming to allocate $50 million in state funds for students enrolled in private, religious, or home-schooling setups.

Tax Rebates for Educational Freedom

Sen. Lori Den Hartog and Rep. Wendy Horman present a bill proposing tax rebates as an alternative means to support education beyond public schools. The bill, designed to offer $5,000 in refundable tax credits on a first-come basis, seeks to cover qualified education expenses, including private school tuition, for students in grade school. The plan, capped at $40 million, further allocates $10 million to provide the same benefit to low-income families eligible for the federal earned income tax credit.

The proposed legislation aims to expand educational choices by providing financial support to families opting for alternatives such as private schools, religious institutions, or home-schooling.

Sen. Den Hartog emphasizes the inclusive nature of the bill, encompassing families with diverse educational arrangements, including those forming “learning pods” or engaging in creative educational setups. The Idaho State Tax Commission would oversee both programs to ensure accountability.

READ ALSO: Navigating the Tax Season Buffet: Maximizing CRA Refunds Through RRSP Contributions

Previous Challenges and Ongoing Concerns

While a similar proposal failed in the Senate last year due to concerns about program costs, the current plan introduces a tax rebate arrangement with a cap to address financial apprehensions. The bill doesn’t mandate income maximums for parents, aiming to support education for all children.

Critics, including Democratic Rep. Lauren Necochea, express concerns about potential financial strain on public schools and question the adequacy of the $5,000 rebate for tuition at private institutions.

READ ALSO: Abuja-Based Firm Advocates Tax Rebates to Facilitate Affordable Housing Development