Arkansas had 35.6 mortgage refinances per 1,000 households in 2022, below the national average.

Changing Landscape: Mortgage Refinances Drop Amid Rising Interest Rates

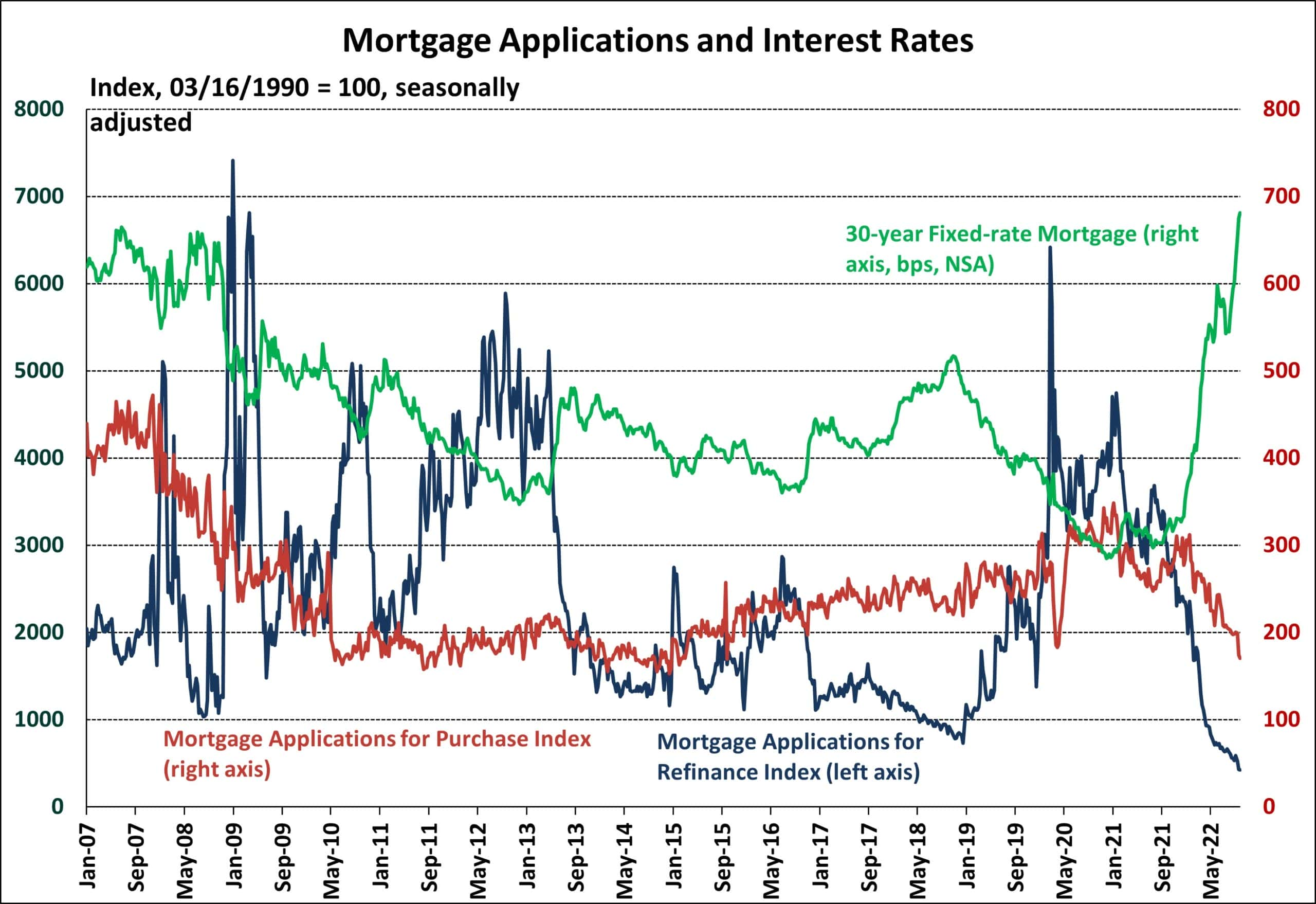

Refinancing applications have dropped due to increased mortgage interest rates. Many homeowners refinance their mortgages to cut interest rates or lengthen the term. Certain refinancing options may also give homeowners cash for home equity. As the U.S. economy evolves, so will mortgage refinancing.

The mix of U.S. mortgage refinances has changed. Due to historically low interest rates, mortgage refinances increased by 145% in 2020 and maintained similar levels in 2021. The number of mortgage refinances dropped by over 70% to 2.3 million in 2022. Due to rising property values during the COVID-19 pandemic, 54% of refinances were cash-out.

Nearly 35% of mortgage refinancing applications are denied due to an insufficient debt-to-income ratio. In almost 25% of denials, credit history is the second factor. Refinancing applications denied show the difficulties people confront while trying to lower monthly payments or acquire liquidity.

Regional Variation in Mortgage Refinances

Mortgage refinancing differs per U.S. area. In 2022, 42.1 mortgage refinances per 1,000 households were granted nationwide. Western states have higher refinancing rates due to rising housing values. Utah has the most mortgage refinances per 1,000 households (70.3), followed by Idaho (63.4) and Arizona (56.2). In comparison, Alaska has the fewest refinances (26.0 per 1,000 mortgaged families).

Construction Coverage researchers used FFIEC and Census Bureau data for this analysis. The rankings used only conventional single-family mortgage refinances from 2022 per 1,000 households with a mortgage.

READ ALSO: Arkansas Had 35.6 Mortgage Refinances per 1K Households in 2022, Fewer Than U.S. Average