This marks the third consecutive pause since July, with the central bank maintaining the federal funds rate in a range of 5.25% to 5.5%.

The Federal Reserve declared on Wednesday that it will keep its benchmark interest rate unchanged, extending relief for borrowers following the most rapid series of hikes in four decades

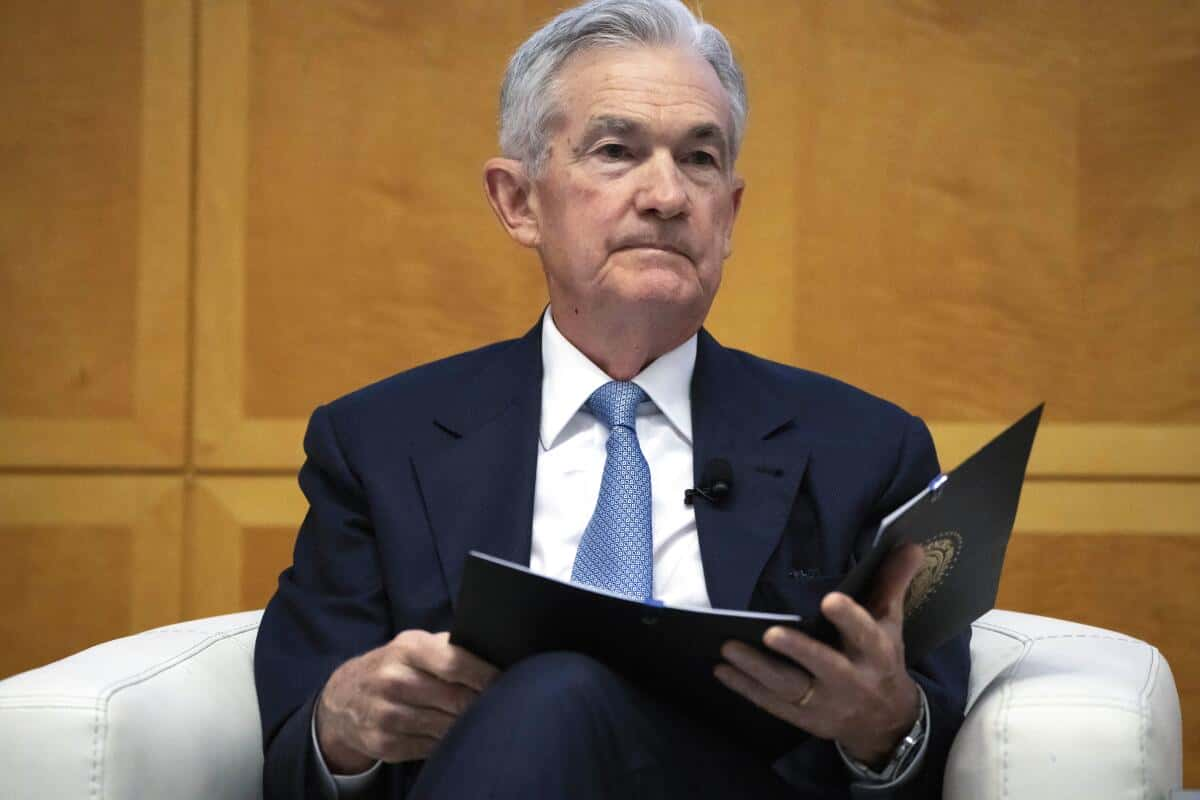

Federal Reserve officials hinted at the potential for a 0.75% percentage point cut in the benchmark rate in 2024, according to projections outlined in their statement. Fed Chair Jerome Powell, during a conference call discussing the decision, emphasized that the “appropriate level will be 4.6% at the end of 2024” if economic projections hold. The stock market responded modestly, with the S&P 500 gaining 0.5% immediately after the release of projections outlining the expected interest rate unchanged path for the coming year. Such rate cuts, if implemented, would alleviate borrowing costs across the economy, providing relief to consumers impacted by increased costs for various loans, including mortgages and credit card debt.

The Federal Reserve has raised the federal funds rate 11 times since initiating the tightening cycle in March 2022 to counter the highest inflation in 40 years. While successful in curbing inflation, these actions have led to higher borrowing costs, affecting homebuyers and increasing expenses for cars, credit card debt, and loans. Most Wall Street economists anticipate that the Fed will maintain the benchmark rate for several more months, speculating on a potential rate cut in May or June 2024.

Fed officials anticipate a 75 basis points cut in rates in the upcoming year, exceeding the 50bps forecasted in September

Powell, in a recent press conference, highlighted the central bank’s commitment to maintaining price stability, even as strides are made in reducing inflation. Despite ongoing progress, he underscored the possibility of raising rates if deemed essential. The anticipation of rate cuts in 2024 has played a role in the current stock market surge, making Powell’s forthcoming remarks eagerly awaited.

Investors seek insights into the economic trajectory and the likelihood of a smooth economic transition, emphasizing the delicate balance between sustaining growth and addressing inflation concerns. Powell’s statements carry significance in shaping expectations and guiding market sentiment.