Emphasizing his concerns, Kiyosaki reiterated, “America is now bankrupt,” questioning how the nation, once considered the wealthiest globally, found itself in this dire situation.

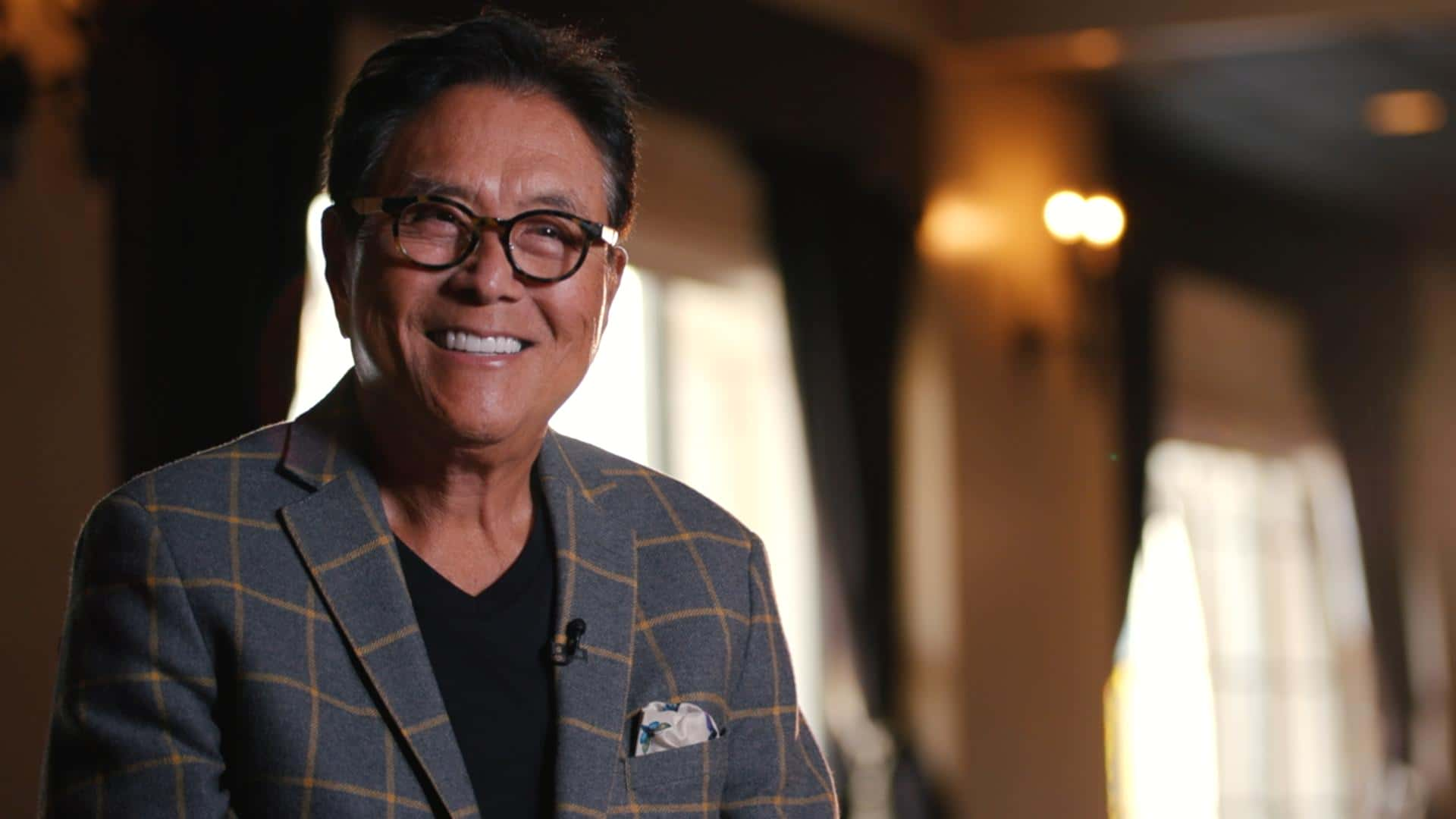

Financial guru Robert Kiyosaki recently raised significant alarms about America’s fiscal health during an episode of “The Rich Dad Radio Show.”

Despite the absence of a formal declaration of bankruptcy by the U.S., Robert Kiyosaki‘s remarks highlight the escalating debt crisis gripping the country. The national debt soared to $33.8 trillion by November 24, with experts like Jim Clark, CEO of Republic Monetary Exchange, suggesting that actual liabilities, including entitlements, could surpass a staggering $200 trillion. In the fiscal year 2023, interest payments on this debt surged to $659 billion, marking a 39% increase from the prior year and nearly doubling the amount recorded in fiscal 2020.

Robert Kiyosaki, a firm advocate for safeguarding wealth, places great faith in physical assets. Among his preferred choices, he promotes investing in real estate. He recently touted ownership of 15,000 houses, leveraging them as a hedge against inflation. Referencing historical data from the Federal Reserve Bank of St. Louis, Robert Kiyosaki highlights real estate’s ability not only to keep pace with inflation but to potentially surpass it, with median sales prices of homes soaring by 2,353.93% since 1963.

Robert Kiyosaki champions investments in precious metals like gold and silver, viewing them as buffers against inflation and currency devaluation

His strategy echoes the prospects available through fractional real estate investing, enabling individuals to invest in income-generating properties for as little as $100, offering opportunities for rental income and long-term appreciation.

While Robert Kiyosaki’s approach aligns with safeguarding wealth amidst economic uncertainty, it’s crucial to note that these strategies might not suit everyone. Conducting thorough research and consulting with qualified financial advisers remains essential.