The number of student loans discharged continued to increase as loan borrowers filed bankruptcy to avoid paying their debts.

Student Loans Discharged Continues Due to Loan Borrowers Filing Bankruptcy to Avoid Paying Debts Following Resumption

The student loans discharged continued to increase due to high numbers of loan borrowers who have decided to file bankruptcy to avoid paying their debts following the student loan payment resumption, which led to the student loans discharged of some borrowers.

According to a report published in GO Banking Rates, there are already more than 600 student loans discharged due to bankruptcy as loan borrowers had a hard time budgeting their finances with the increasing interest rates amidst inflation and high cost of living, leading to their decision to have their student loans discharged.

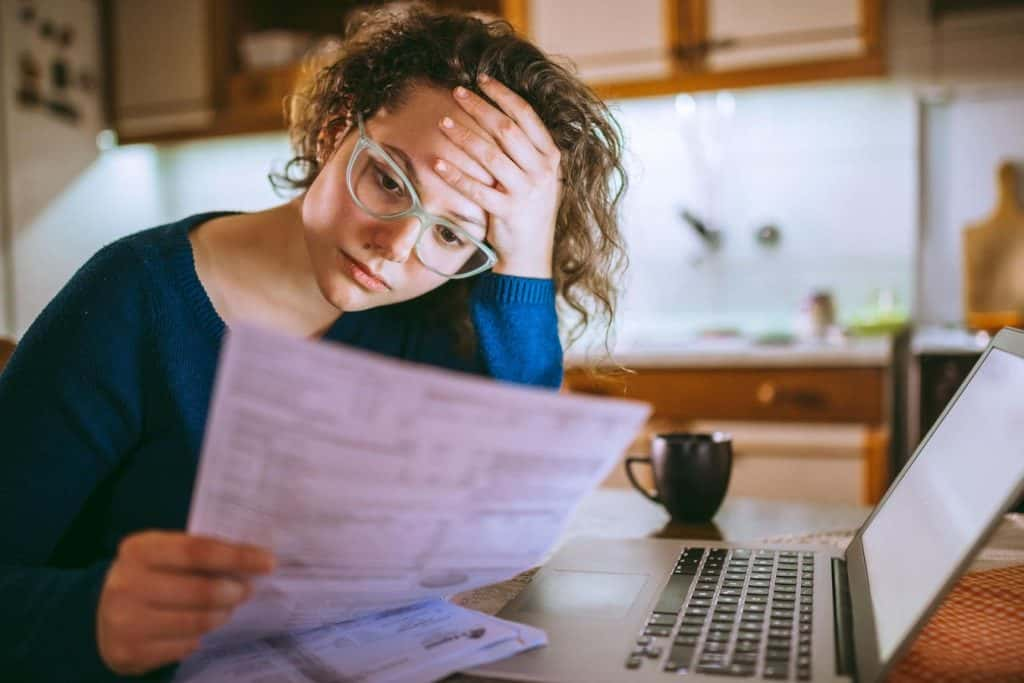

Despite the high number of student loans discharged, financial experts discouraged loan borrowers from filing bankruptcy just to erase their debts because it would reduce their credit score, affecting their jobs or when buying a home even with their student loans discharged.

READ ALSO: How Student Loan Payment Resumption Affects Millions Of Loan Borrowers Amidst Lack Of Debt Relief

Loan Borrowers Encouraged to Look for Alternatives Instead of Filing Bankruptcy to Have Their Student Loan Discharged

Instead of filing bankruptcy to have their student loan discharged, loan borrowers were encouraged to look for alternatives to prevent further financial burdens in the future.

Loan borrowers should look for other sources of income or reevaluate their finances to pay for their debts and as much as they can, avoid filing bankruptcy just to have their student loan discharged, CNBC reported.

READ ALSO: Medical Debt Impact On Low Income Families Worsen As Increasing Debt Pushes Them Into Bankruptcy