The House Joint Resolution 2 proposes a constitutional change to enact this tax cut, and voters will have the opportunity to decide on it in November.

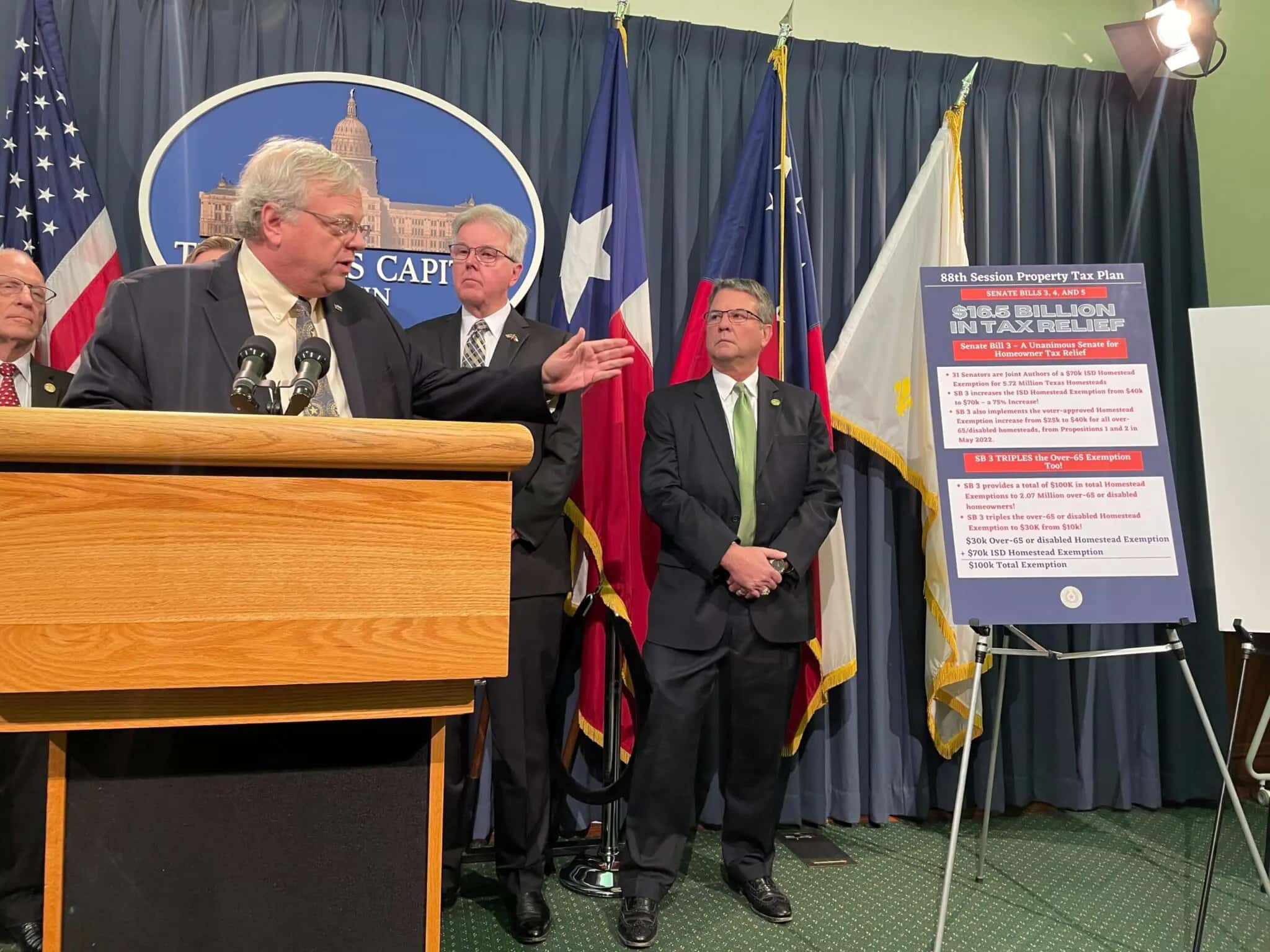

A tax cut resolution aimed at reducing property tax burdens for Texas homeowners and businesses is currently under consideration

Wichita Chief Appraiser Lisa Stephens-Musick highlighted the benefits of the resolution, particularly the increase in the homestead exemption, which reduces the value of state property for school taxes. The current exemption of $200,000 is set to be raised under Senate Bill Two, a positive development for homeowners.

What sets this tax cut proposal apart from previous ones is its inclusion of non-homestead properties. These non-homestead properties would have a cap of 20 percent tax rates value increase each year.

For residential properties, the taxable value increase is limited to 10% for the new non-homestead pass portion

In simple terms, the market value of owned properties may increase, but the tax cut burden will be capped at 20 percent for businesses with a value of less than $5 million. Franchises will also enjoy an exemption if their annual revenue is less than $2.47 million.

The exact amount of money to be saved will depend on the tax cut set. However, there is an expectation of a tax rate decrease due to the value increases and caps imposed by the state on annual increases.

Overall, the tax cuts are still subject to the voting process in November. Both Stephens-Musick and Mark Bruce, who supports the proposal, believe that if approved, it will bring substantial benefits to consumers.