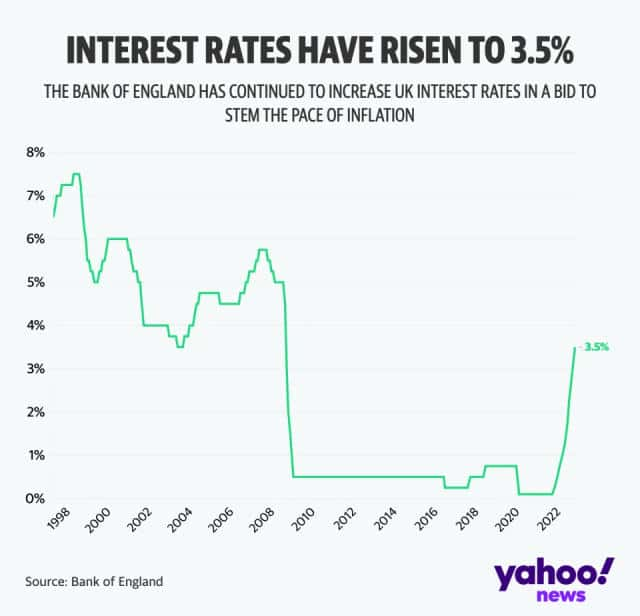

However, pressure on the Bank of England (BoE) may be easing as interest rates may peak sooner than projected.

The Bank of England interest rates are expected to raise by 0.25 percentage points on Thursday, August 3

It would be the 14th consecutive increase, but it would be a lower increase than the unexpected 0.5 percentage point increase to 5% in June.

Experts believe that the recent UK inflation data, which indicated a larger-than-expected reduction in price growth, has relieved some of the pressure on the central bank.

According to the Office for National Statistics (ONS), consumer price index (CPI) inflation was 7.9% in June, down from 8.7% in May and the lowest rate since March 2022.

It implies that the Bank of England interest rates, which are a tool used by the Bank to reduce inflation to its 2% objective, may not need to rise as high as previously anticipated.

In the United Kingdom, experts predict a quarter-point increase in interest rates in August, with at least one more hike in the months ahead.

According to researchers from ING Economics and Deutsche Bank, the Bank of England interest rates might reach 5.75% this year.

“Beyond this month (August), we are sticking with our prediction of another rate increase in September, at which point the present rate rise cycle should come to an end,” said Andrew Goodwin, chief UK economist for Oxford Economics.

A last quarter-point boost will be implemented the following month, according to Investec Economics, which also thinks the Bank will choose to increase rates by a larger 0.5 percentage point on Thursday.

It raises the prospect that the rising pressure on debtors will be relieved.

According to researchers from ING Economics and Deutsche Bank, the Bank of England interest rates might reach 5.75% this year. On July 11, expectations for peak Bank of England interest rates hit 6.5% as data revealed record wage growth. However, they retreated following a larger-than-expected drop in consumer price inflation. Investors are currently evenly divided between a peak of 5.75% or 6% late this year or early in 2024.

Here are the four things to look out for this Thursday.

1. Mortgage rates rising

The amount your bill will increase depends on the type of mortgage you have.

Those on fixed-rate mortgages are secure for the time being, but remortgaging will result in a significant increase in borrowing rates.

Lloyds Banking Group, the UK’s largest lender, warned that customers who stick to a mortgage agreement for the remainder of the year might face a £360 rise in monthly repayments.

Other mortgages, such as a tracker or standard variable rate (SVR), may be affected immediately.

There are now 639,000 outstanding residential tracker mortgages.

Homeowners with variable-rate mortgages may not experience an immediate rise in payments, but they will most certainly climb shortly after Bank of England interest rates are raised.

However, the exact amount is determined by your borrowing and the loan-to-value ratio.

2. Credit card and loan rates could rise

Borrowing costs for loans, credit cards, and overdrafts may rise as well since banks are likely to pass on the increased rate.

Certain loans, such as a personal loan or auto financing, will normally remain the same because you have already agreed on the interest rate.

However, future loan rates may rise, and lenders may raise interest rates on credit cards and overdrafts – but they must notify you in advance.

If you want to cancel a credit card, you have 60 days to pay off any outstanding balance.

Personal loan interest rates have already reached their highest level since October of last year.

3. Savers could get better rates

Savings may receive additional relief as banks compete to give market-leading interest rates.

The rise of Bank of England interest rates is often excellent news for savers, especially after a period of receiving extremely low yields on their money.

Another rate hike could result in banks passing on higher rates to saving, though this is normally considerably slower than passing on higher rates for borrowing.

Anyone who is now receiving a low return on easy access savings may find it worthwhile to shop around for a better rate after any rate increase and move their money.

According to MoneyFactsCompare, savers can currently earn up to 4.55% in easy-access savings accounts and up to 6.1% in some fixed bond accounts.

4. Inflation will remain high for now

Your money will not be as valuable as it once was due to growing prices for goods and services, which are reflected in rising inflation.

To combat inflation, the rise of Bank of England interest rates is good, which reduces spending power and demand, causing prices to fall.

As part of that announcement, the Bank of England will state its views on the economy and provide new estimates for inflation and GDP.

In June of this year, the rate of inflation in the United Kingdom fell more than expected to 7.9%.

However, despite the data slowing, it still means that costs for common necessities are rising faster than the Bank of England, which has a 2% inflation target.