The San Diego Housing Commission began a pilot program on Thursday to assist low-income households of color in obtaining property ownership in San Diego. It provides grants and deferred loans of up to $40,000 to first-time homeowners to help with down payments.

The Program Is A Historic Step Forward In Address Racial Disparities In Property Ownership

According to Sujata Raman, the commission’s vice president of single-family housing finance, the program has funding to assist 80-100 homebuyers. It will not close the city’s racial disparities in property ownership, she claims. She did, however, call the program a historic step forward.

“Every little bit helps,” remarked Raman. “This is the first program of its kind in San Diego, where we have a race-conscious program through a government agency.”

In San Diego, non-Asian households of color have lower homeownership rates than the general population. Compared to more than 60% of white households, less than a third of Black households own. According to U.S. Census data, the county’s Black, Native American, Native Hawaiian, and Pacific Islander citizens’ rates of house ownership have fallen marginally over the last decade. Census information.

READ ALSO: Harris County Commissioner Announce 20.5 Million Pilot program To Address Economic Inequality

This Disparity Was Caused By Racist Practices In Housing And Lending

The Federal Housing Administration refused mortgage insurance to people of color from its inception in the 1930s until the Fair Housing Act of 1968, while offering enormous subsidies for new home sales nearly entirely to white customers. These deeds frequently contained racial covenants that limited any subsequent sale of the home to white buyers.

Ryan Clumpner, vice chair of the Housing Commission’s board, sees homeownership as an important component of the greater racial wealth disparity.

“Homeownership brings with it the opportunity to establish generational wealth,” he explained. “That will have long-term benefits for families.”

A household of color must meet the following requirements to qualify:

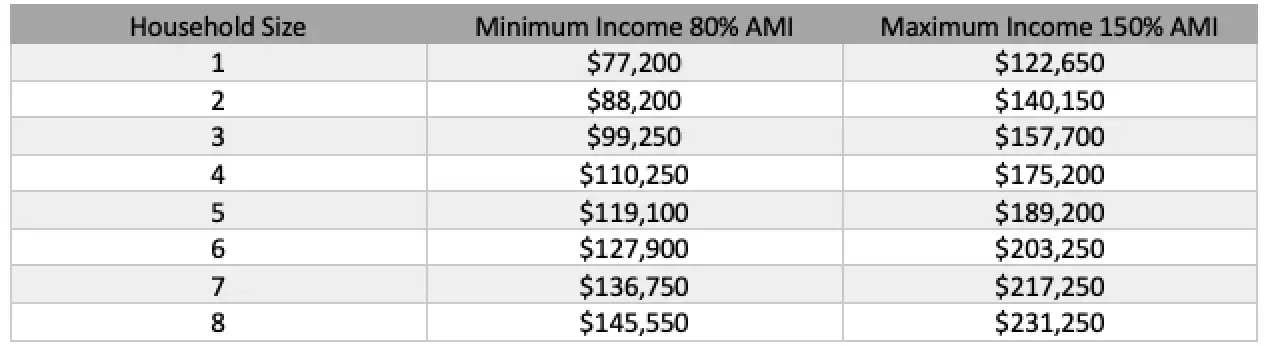

- Earn between 80% and 150% of the typical salary in the San Diego area (see chart below).

- A minimum middle credit score of 640 is required.

- Maintain a monthly debt-to-income ratio of no more than 50%.

- Make a down payment of at least 1.5% of the buying price.

- In the last three years, I have not owned a home.

The grants are available on a first-come, first-served basis, according to Raman of the Housing Commission.

The state’s considerably larger first-time home buyer assistance program recently ran out of funding in less than two weeks.

The commission has not yet established a helpline for the initiative. The first step, according to Raman, is to contact one of its approved lenders.

Click here to view program requirements.

Click here to view a list of approved lenders.