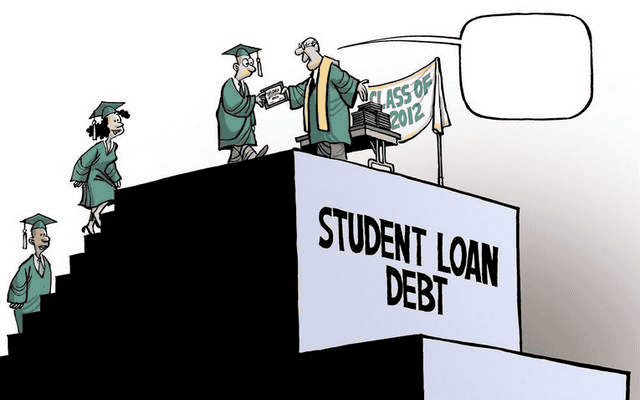

Under both the Trump and Biden administrations, the student loan moratorium was renewed several times. Borrowers haven’t had to make a student loan payment since March 2020. The payment holiday, though, is expected to end this summer.

If you’ve never made a student loan payment or aren’t sure what to anticipate after the moratorium ends, here are a few things to consider.

Student loan repayments may resume in August.

The Biden administration originally stated that student loan payments will restart 60 days after June 30, maybe sooner if the U.S. Before that, the Supreme Court rendered a decision on Biden’s student loan reduction scheme.

The debt ceiling agreement makes little difference to that schedule. According to the agreement, all federal student loan borrowers must begin payments by the end of August.

Loan information will be available before the payment due date.

To ensure that you are not left in the dark, the United States Department of Education maintains a database of all federal student aid information. Here is some information you will be able to obtain before your payment is due:

- Repayment plan options

- Timeline to make your first payment

- How to make payments

Your payment will not be required as soon as the payment freeze breaks, according to the government’s student aid website. At least 21 days before your payment deadline, you will get payment details such as the amount and due date.

READ ALSO:

There are various repayment alternatives available.

If you haven’t budgeted for it, making student loan payments after a three-year break may be difficult. You don’t have to worry about a one-size-fits-all payment plan, thankfully. You can select the best repayment arrangement for you.

You’ve probably heard of the conventional repayment plan, which involves fixed payments for up to ten years. You might pay off your debt more quickly and save money on interest payments during the term of your loan. However, there is one major disadvantage to consider: higher monthly payments than other federal loan options.

If you are unable to devote a higher portion of your income to student loan payments, you may be eligible for other repayment choices such as:

- Graduated repayment plans are similar to conventional repayment plans in that they last up to ten years, but the installments are not fixed. Your payments will begin low and gradually climb every two years. If you expect your income to rise over time, this payment schedule may be suitable.

- Revised Pay As You Earn Repayment (REPAYE): For 20 or 25 years, your monthly payment will not exceed 10% of your discretionary income. Your outstanding student loan balance would then be forgiven.

- Pay As You Earn Repayment (PAYE): You may be eligible for this repayment option if you have a newer federal loan. Your monthly payments would be limited to 10% of your disposable income. Whatever the final payment amount is, it must be less than what you would have paid under the usual repayment plan. Your remaining loan sum would be forgiven after 20 years.

Before proceeding with a repayment plan, it is advisable to review the repayment qualifications and read all of the payment information.

Don’t squander your summer.

This summer, student loan installments may be the last thing on your mind. However, if you plan ahead of time, you could end up saving yourself a lot of money and trouble in the long run. The more you plan ahead of time, the sooner you can cross student loans off your to-do list and start crushing your other financial objectives.

This card is used by our credit card experts and has the potential to earn you $1,306

This top-rated card gives one of the best cashback rates (up to 5%), 0% interest on purchases and debt transfers until 2024, and has no annual fee.

These are just a few of the reasons why our experts decided to sign up for this card after reviewing it. Remember that credit cards are more secure than debit cards and can help you improve your credit score when used correctly. Please keep in mind that we may receive remuneration from products featured on this site, which does not impact our opinions.

READ ALSO: Gov. Shapiro And Legislature Seek Tax relief, Reduction Of Taxes, And Police Funding