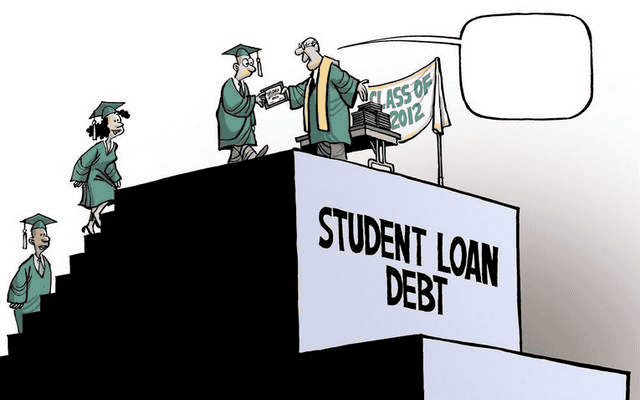

Federal student loan bills will resume in a few months after a break of more than three years.

Borrowers May See Changes To The Federal Student Loan Program When Repayment Resumes

There is a clause that formally ends the moratorium on federal student loan payments and might make it more difficult for the United States in the debt ceiling agreement that President Joe Biden signed into law last week. Extension requested by the Department of Education.

As a result, the next due date for the 40 million Americans who have student loan debt will probably fall in September.

The Biden administration has been working to revamp the federal student loan program throughout the pandemic, so borrowers may observe a number of changes already in place or in the works when they restart repayment.

READ ALSO: 750,000 Americans Could Lose Food Stamp Benefits Due To Debt Deal

These are the first three.

Reduced payments as a result of forgiveness.

Tens of millions of Americans would have their student debt forgiven by $10,000 under Biden’s ground-breaking plan, or up to $20,000 if they had gotten a Pell Grant in college, a sort of aid offered to low-income students.

The administration’s application site, however, had only been operational for a little more than a month when a number of legal changes compelled them to close it. Two of those court cases challenging the scheme will be heard by the Supreme Court.

The justices are still debating the validity of the debt-relief policy and are expected to make a ruling by the end of the month.

If the highest court greenlights the president’s program, roughly a third of those with federal student loans, or 14 million people, would have their balances entirely forgiven, according to an estimate by higher education expert Mark Kantrowitz.

According to Kantrowitz, these borrowers most likely won’t have to make another student loan payment.

READ ALSO: Pennsylvania House Approves Bill To Increase Property Tax And Rent Subsidy For Seniors

After the relief, the Education Department has stated that it intends to “re-amortize” borrowers’ lesser obligations for those who still owe money. It will adjust people’s monthly payments based on their reduced tab and the number of months they have left on their repayment timetable, according to that arcane term.

Kantrowitz gave this illustration: Assume a person has $30,000 in student loan debt with a 5% interest rate.

Prior to the epidemic, they would have made a monthly payment of about $320 over a 10-year repayment period. If forgiveness is granted and that person receives $10,000 in relief, their overall debt would be halved, and their monthly payment would fall in half, to about $210 per month.

But if the top court invalidates the program, the majority of borrowers would probably continue making the same monthly amount that they did before the outbreak, according to Kantrowitz.

A New Repayment Option Based On Income

For borrowers of student loans, the Biden administration is attempting to implement a new, more affordable repayment plan.

This option alters one of the four already available income-driven repayment plans, which cap borrowers’ debt payments at a percentage of their discretionary income in an effort to make debt repayment more manageable.

Under the new program, the Revised Pay as You Earn Repayment Plan, borrowers would be expected to pay 5% of their discretionary income toward their undergraduate student loans each month rather than 10% of their discretionary income currently.

Kantrowitz gave an illustration of how the revamped choice may affect monthly bills.

A borrower making $40,000 annually used to have a monthly student loan payment of almost $151. The new arrangement reduced their payment to $30.

Similarly to that, Kantrowitz said someone making $90,000 annually may see their monthly payments drop from $568 to $238.

According to him, the payment plan will be accessible by July 2024, while “it is feasible that the adjustments could be implemented earlier, as the U.S. In some situations, the Department of Education is free to enact regulation modifications earlier.

new servicer taking care of their debts

Many borrowers may need to get used to a new servicer when payments restart since several of the biggest corporations that service federal student loans stated they would stop doing so during the Covid-19 crisis.

The Pennsylvania Higher Education Assistance Agency (commonly known as FedLoan), Granite State, and Navient, the three corporations in charge of managing the loans, all announced they would be terminating their contracts with the government.

As a result, Kantrowitz estimates that by the time payments restart or shortly thereafter, 16 million borrowers will have to deal with a different organization.

“Whenever there is a change of loan servicer, there can be problems transferring borrower data,” Kantrowitz explained. “Borrowers should be prepared for the possibility of glitches.”

Borrowers who are affected should receive repeated alerts about their lender change, according to Scott Buchanan, executive director of the Student Loan Servicing Alliance, a trade group for federal student loan servicers.

If you send a payment to your previous servicer by accident, the money should be routed to your new one, according to Buchanan.

READ ALSO: Gov. Shapiro And Legislature Seek Tax Relief, Reduction Of Taxes, And Police Funding