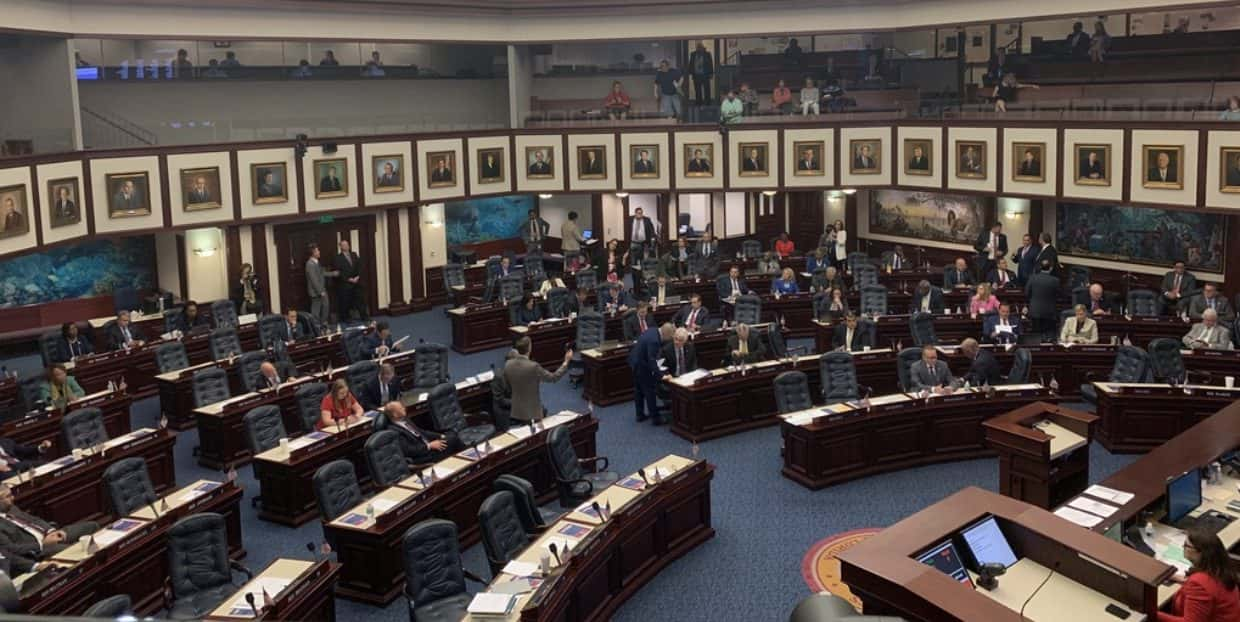

Florida lawmakers are proposing a $1.38b tax package, which includes tax breaks for businesses and shoppers, while the Senate works on its own tax plan.

Florida House approves a $1.38B package of tax breaks for businesses and shoppers

The Florida House Ways & Means Committee approved the package, which will see a reduction in commercial-lease tax, tax holidays, and exemptions on products for babies and toddlers. The House package is similar to the requests made by Governor Ron DeSantis. Meanwhile, the Senate plan is expected to include similar measures to the House proposal, including tax holidays and discounts for baby and toddler products, and reductions in commercial-lease tax. Senate Finance and Tax Chairman, Blaise Ingoglia, stated that the Senate plan may also include measures such as reimbursing local governments for losses during Hurricane Ian, cleaning up Brownfield sites, and tax breaks for aviation fuel, broadband equipment, and firearms-safety boxes.

The House package includes proposals for two 14-day back-to-school tax holidays before the fall and spring terms

It also offers a one-year tax exemption on certain Energy Star appliances, a 14-day tax holiday on disaster-preparedness supplies around the start of hurricane season, oral hygiene products, adult incontinence products, gas ranges, and cooktops. The most expensive proposal in the House package is a reduction in the commercial-lease tax from 5.5% to 4.5%, which would cut state revenue by an estimated $311.5m and local government revenue by $82.9m.

If approved, the package could become the largest tax cut in the history of Florida for one year. The Senate and House will negotiate a final package in the coming weeks.

READ ALSO: How To Reach Retirement Goals For Retirees – Check It Here!