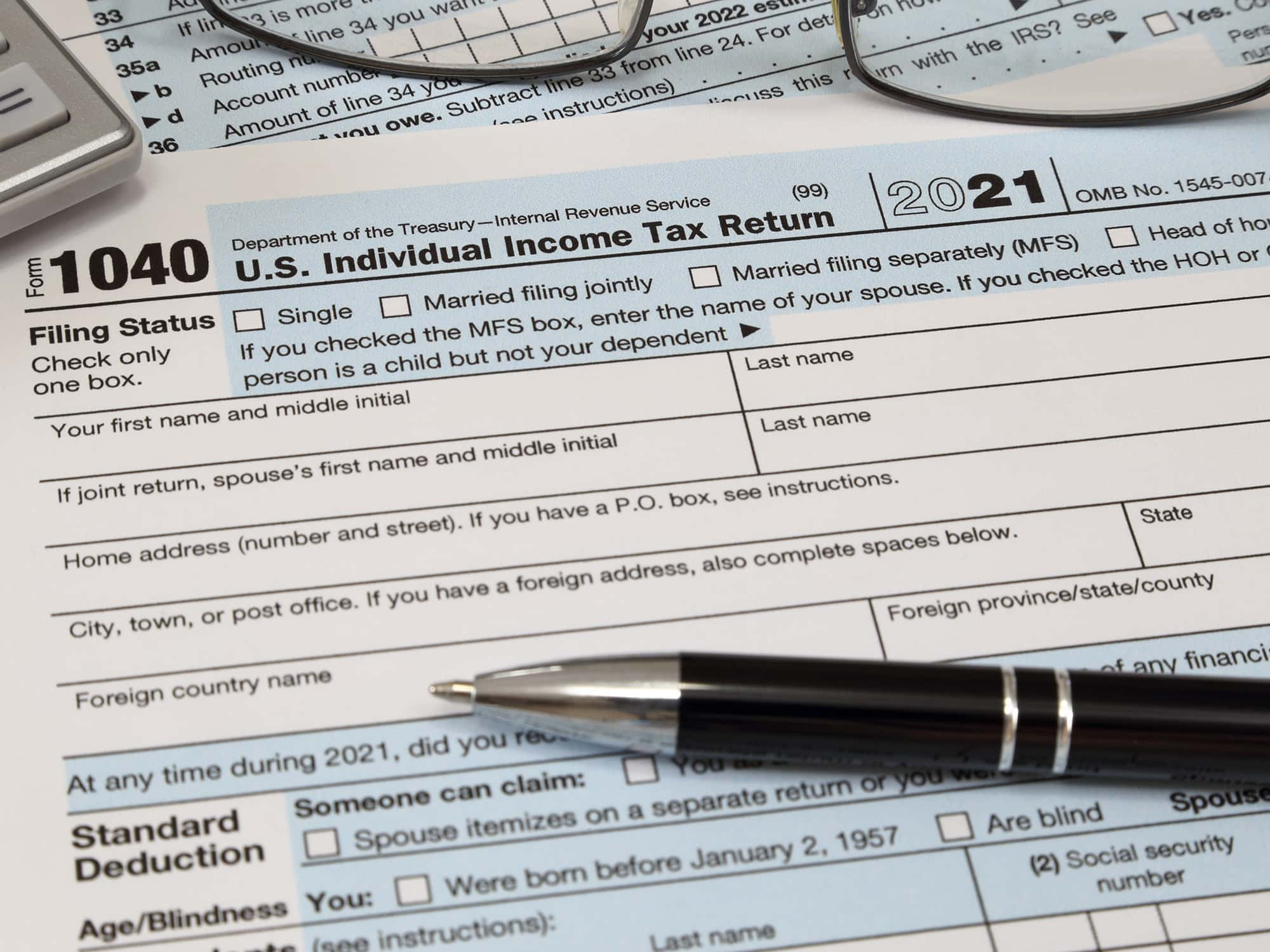

Deadline Approaching for Amending 2019 Oklahoma State Income Tax Returns, Warns Oklahoma Tax Commission

The deadline for making amendments is approaching on July 17 of this year. Oklahomans are being reminded by the OTC that time is running out to make changes or corrections to their accepted 2019 Oklahoma State Income Tax Returns This deadline has been set in alignment with the Internal Revenue Service (IRS), which allows a…